The gas tax increase of 4 cents per gallon, which will eventually increase to 6 cents per gallon, as well as a diesel tax increase that will eventually reach 10 cents per gallon, both go into effect today, July 1, throughout Tennessee. The culprit for this tax increase is Governor Haslam’s IMPROVE Act – Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – later renamed the Tax Cut Act of 2017. As Tennesseans are forced to pay this higher tax, it’s time to review how it happened in a state with record revenues and a billion dollar surplus. It started no later than 2015, when Governor Bill Haslam and Department of Transportation (TDOT) Commissioner John Schroer went on a taxpayer-funded six-week 15-city tour, meeting with elected officials, business leaders and chamber of commerce executives as well as “infrastructure officials and community members” creating a “need” and building support for a gas tax increase. At the time, there was a $6.1 billion backlog of road and bridge projects. Davidson and Middle Tennessee counties that ring it, were provided Resolutions to be passed by their respective legislative bodies, most often a County Commission, that urged Governor Haslam and the Tennessee…

Read the full storySearch Results for: gas tax

Incensed Californians Working to Recall State Assemblyman Who Supported Gas Tax Hike

Earlier this year, the Democrat super-majority in the California legislature passed a substantial gas tax hike. Though wildly unpopular with the relative few who took notice, Governor Jerry Brown signed it quickly, and put into motion an uptick in fuel costs to consumers estimated to raise a staggering $5 billion in new recurring revenues to help underwrite the Golden State’s bloated budget. Republicans, fueled by the outrage of every day Californians at the imminent tax increase, responded by launching a recall effort against newly-elected Assemblyman Josh Newman, whom they say was key to the passage of the tax hike. The Washington Free Beacon reports the effort, led by San Diego radio talker Carl DeMaio, is garnering vast support amongst California voters. The first step to recall a sitting elected official is to gather petitions signed by voters. The Beacon reports, “Republicans opposed to the most recent gas tax hike Newman backed submitted 84,988 signatures for the recall effort on Tuesday, nearly 20,000 more than the 63,592 the law requires.” DeMaio told The Beacon, “The overwhelming number of signatures we collected in just six weeks demonstrates a real rebellion is brewing in California against the out-of-control tax raisers in the state legislature.” He continued, “This recall…

Read the full storyDemocratic Party Official Caught on Video in Profane Rant Against California Gas Tax Opponents

A Democratic Party official was filmed over the weekend berating a group of gas tax opponents trying to collect signatures in Fullerton, California. San Diego City Councilman Carl DeMaio, a Republican, and his husband, San Diego Gay and Lesbian News Publisher Johnathan Hale, were petitioning at a local Wal-Mart to recall Democratic state Sen. Josh Newman…

Read the full storyGubernatorial Candidate Mae Beavers on the Gas Tax Increasing IMPROVE Act: ‘The Joke Is On The People Who Put the Plan Together’

MOUNT JULIET, Tennessee — Gubernatorial candidate Sen. Mae Beavers at an Americans For Prosperity Town Hall meeting Monday evening honoring her and Rep. Mark Pody for voting against the gas tax, said “I think the joke is on the people who put the plan together.” Sen. Beavers was referring to the IMPROVE Act, 4 cent gas and 6 cent diesel tax increases set to go into effect July 1 and then an additional 1 cent and 2 cents, respectively, on July 1, 2018, just before the state primaries are held on August 2, 2018. Given the results of the recent Tennessee Star poll where 48.1 percent of likely Republican primary voters responded that they were more likely to support a gubernatorial candidate who promises to repeal, Sen. Beavers may be right about the impact to State House and Senate incumbents who voted for the gas tax. Sen. Beavers is the only one of three declared gubernatorial candidates who is making the repeal of the gas tax a major topic of her campaign platform. “Most of you know, I was around for the state income tax fight, and this was completely different,” said Beavers of the IMPROVE Act. “It seems like…

Read the full storyTennessee Star Poll: GOP Primary Voters More Likely to Support Gubernatorial Candidate Who Will Repeal Gas Tax Increase, 48 Percent to 29 Percent

The Tennessee Star Poll of 1,007 likely Republican primary voters shows that by a wide margin, 48 percent to 29 percent, they are “more likely to support” a gubernatorial candidate who supports a repeal of the 6 cents per gallon gas tax increase and 10 cents per gallon diesel tax increased passed by the Tennessee General Assembly and signed by Gov. Haslam last month. When asked “Are you more likely or less likely to vote for a candidate for governor who promises to repeal this gas tax increase if elected?” 48.1 percent of likely Republican primary voters said they were more likely to support such a candidate while 29.8 percent said they were less likely to support that candidate: 24.3% Much more likely to support 23.8% Somewhat more likely to support 16.5% Somewhat less likely to support 13.3% Much less likely to support 22.1% Not sure/don’t know That is good news for State Senator Mae Beavers (R-Mt. Juliet), the only one of the three announced candidates who supports repeal of the gas tax increase. In fact, at her announcement on Saturday, Beavers declared repeal of the gas tax increase will be one of her top priorities, if she is elected…

Read the full storyMae Beavers Tells Haslam State Will Pay For Roads After Gas Tax Repeal With $2 Billion Surplus and Ending Diversion of Road Funds to Other Uses

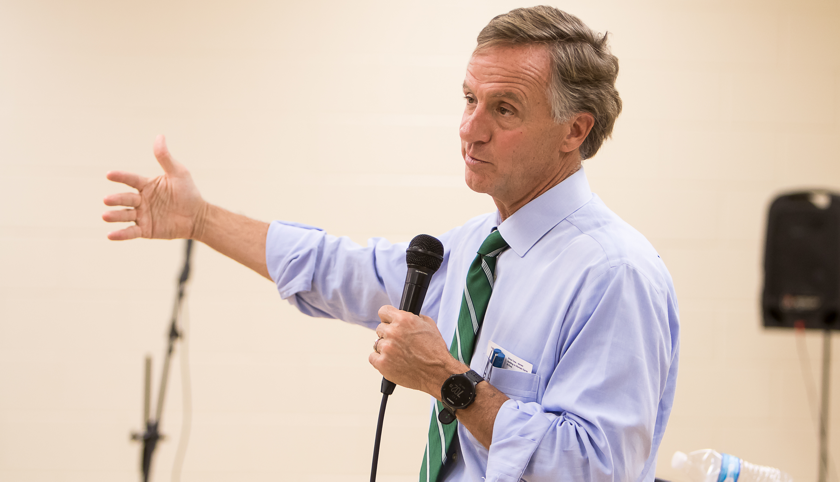

Gov. Bill Haslam threw a soft ball over the middle of the plate to State Senator Mae Beavers (R- Mt. Juliet) about her campaign pledge to repeal the gas tax, and the recently announced GOP Gubernatorial candidate knocked it out of the park. Appearing in Nashville at one of the three ceremonial signings for the IMPROVE ACT passed by the Tennessee General Assembly this session that he signed in May, Haslam asked what he thought of Beavers’ campaign pledge to repeal the 6 cents per gallon gas tax increase and 10 cents per gallon diesel tax increase included in the new law. “If you want to repeal that, then how are you going to pay for road improvements? And are you going to take the tax cuts that we’ve made off the table, too?” Haslam asked. “That’s an easy question to answer,” Beavers told The Tennessee Star Monday afternoon. “If the Governor and legislative leadership had allowed for a full and fair discussion of road funding alternatives rather than cutting back room deals and strong arming the gas tax increase down taxpayers throats then Governor Haslam might be aware of the other alternatives available,” Beavers noted. “We can repeal…

Read the full storyGas Tax Increase Fails in Louisiana

The Hayride is reporting that the effort to increase the gas tax in the state of Louisiana has failed in the State’s House of Representatives: We heard this morning from several people in the know that at last night’s meeting of the Louisiana House Republican Delegation, Rep. Steve Carter admitted to the members that HB 632, the gas tax increase bill he’s been trying to drag across the finish line for this entire legislative session, simply does not have the 70 votes required for passage on the House floor. And shortly thereafter, the Louisiana Association of General Contractors, which had been attempting to rally support for Carter’s gas tax bill, threw in the towel on the gas tax. That association’s CEO Ken Naquin said as much in an e-mail to AGC’s membership… From: Ken Naquin Sent: Wednesday, May 31, 2017 10:27 AM To: LAGC Subject: Fuel Tax Bill Dead for Session To: LAGC Highway Division Members Ladies and Gentlemen: Yes, the tag line is correct. Rep. Steve Carter will address the House floor today and hang HB 632 up, on the calendar. As of late last night, after an exhaustive full floor lobby, we can only garner 60 yes votes,…

Read the full storyBREAKING: Mae Beavers Plans to Announce Campaign for Governor on Saturday, Promises ‘A Full Effort to Repeal the Gas Tax Increase’

State Senator Mae Beavers (R-Mt. Juliet) has decided to run for the Republican nomination for Governor of Tennessee in 2018, and her top priority will be repeal of the recently enacted 6 cents per gallon gas tax increase pushed by Gov. Haslam. Beavers released a statement late Saturday that says she “intends to formally announce a campaign for Governor of Tennessee at Charlie Daniels Park in Mt. Juliet at 1 pm on Saturday June 3.” She will become the third candidate officially in the race for the GOP nomination. Knoxville businessman Randy Boyd and Williamson County businessman Bill Lee have already announced their candidacies. Congresswoman Diane Black, State Senator Mark Green (R-Clarksville), State Senator Mark Norris (R-Collierville), and Speaker of the Tennessee House of Representatives Beth Harwell (R-Nashville) are all potential candidates. With her announcement, Beavers becomes the only clearly conservative announced candidate in the race, and is the only candidate, announced or expected, to come out in support of repealing Gov. Haslam’s gas tax increase. “Over the past several weeks, it has become increasingly clear that conservatives in Tennessee are looking for bold leadership that will not shrink from standing up and speaking up on the key issues…

Read the full story70 Grassroots Activists Honor Gas Tax Opponents at Knoxville Event

KNOXVILLE, Tennessee — Seventy grassroots activists came out to hear a debriefing Tuesday evening on the recently concluded legislative session by Knoxville Republican gas tax opponents Representatives Roger Kane and Jason Zachary at an Americans For Prosperity (AFP) West Knoxville Town Hall. Kane and Zachary were recognized by AFP’s Deputy State Director, James Amundsen, as the only two Knoxville representatives who voted against the gas tax increase. Representatives Zachary and Kane gave opening comments to the standing room only crowd at O’Charley’s on Parkside Drive in the Turkey Creek section of Knoxville followed by a question and answer session for an event that ran more than an hour. Zachary started his comments by passing out and reviewing two handouts printed on his official letterhead, “Under Conservative Leadership, Tennessee is a Better Place To Live, Work, And Raise A Family” and “Bills Passed On Behalf Of District 14, 2017 Session.” As he went through the six bills, HB 0055, 0056, 0057, 0362, 0368 and 0469, Zachary explained how they came about through requests by individuals, making the point that “especially at the state level, one person can make a tremendous difference.” Kane made a similar point when he said, “We actually…

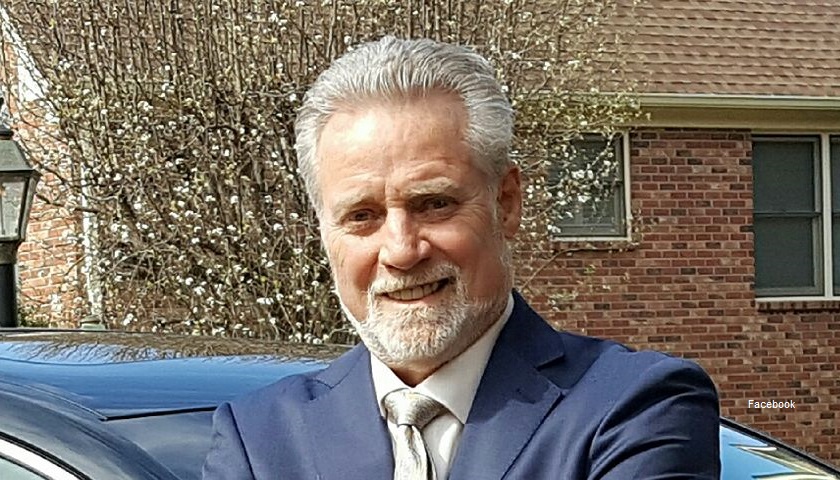

Read the full storyFormer Lt. Gov. Ron Ramsey Says ‘There Was Some Punishment Levied Against Some House Members’ for Voting No on Gas Tax

During a press conference in Blountville, former Lt. Governor Ron Ramsey said that, “[w]hen I was in the legislature, let me assure you, actions had consequences,” as the reason why none of the new transportation funding is headed to Washington County. Ramsey summed it up this way: “There was no doubt, in the end, that there was some punishment levied against some House members on funding. Not against the Senate members, but against the House members.” For example, Ramsey said the Senate included funding for the Sullivan County Agriculture Center and East Tennessee State University, after which the House stripped away some of the funding. Rep. Timothy Hill, whose district covers Johnson County and parts of Carter and Sullivan Counties, voted against the gas tax. “Well, Timothy Hill’s district is the Ag Center. That’s one. I even made a phone call to say, ‘That this is kind of my pet project.’ It’s not up to the House members on that, but still they felt like it was time to ‘exact a pound of flesh’ was exactly the words that I heard” No TDOT projects were included for Johnson County which Hill also represents. Similarly, there were no TDOT projects listed for…

Read the full storyAFP Sponsors ‘Day at the Capitol’ for Key Vote in Louisiana Gas Tax Hike Battle

If it seems like every other State in the Union has either raised their fuel tax – or is working on it – it’s because they are. A full 21 states’ legislatures have proposed raising the gas tax, and more of those proposals have been successful than not. California and Tennessee consumers will see a sharp increase in prices at the pump thanks to increased taxes; while South Carolina’s governor just spared his constituency by vetoing a gas tax hike. Louisiana is up next, with a vote Tuesday in the powerful Ways and Means Committee which will determine the fate of a years-long battle to raise the gas tax there. Americans for Prosperity (AFP), whose Tennessee state group opposed the gas tax in Tennessee, is sponsoring a “Day at the Capitol” through its Louisiana state group. Activists are called to gather Tuesday, May 16 in Baton Rouge from 9 a.m. to 12 p.m. at the Ways and Means Committee room. The hearing begins at 9:30 a.m. The Hayride reports: There are 19 members of the House Ways And Means Committee – 12 Republicans and seven Democrats. HB 632 by Rep. Steve Carter, which is the gas tax bill, has eight…

Read the full storyCalifornians Are Revolting Against Democrats Who Voted For Gas Tax Hike

Californians are pushing back against the Democratic lawmakers who passed the largest gas tax in the state’s history last month. Citizens have signed signatures for a recall effort against Democratic state Sen. Josh Newman for his vote in favor of for the Road Repair and Accountability Act, and another lawmaker is moving forward on an initiative…

Read the full storySC Gov. McMaster Vetoes Gas Tax, In Stark Contrast to TN Gov. Haslam, Who Championed It

South Carolina Governor Henry McMaster posted a video “Gas Tax Veto” to his Facebook page, saying “Today I vetoed the General Assembly’s gas tax bill, and I would like to tell you why.” He continued, “Unfortunately, raising taxes was the only solution seriously considered by the legislature.” Quite a contrast to recent events in Tennessee, where Governor Haslam was the one who would only accept a gas tax increase to fund roads through his IMPROVE Act. The Governor persisted in his “my way or the highway” solution to road funding, despite other alternatives being offered by some members of the House of Representatives, and nearly half of his own party at 35 of 37 Republican Representatives, voting against it. Tennessee suffers from much the same problem as South Carolina, as stated by Governor McMaster, “Right now over one-fourth of your gas tax dollars are not used for road repairs. They’re siphoned off for government agency overhead and programs that have nothing to do with roads.” As previously reported by The Tennessee Star, some of the current road “user fees” are diverted from the Highway Fund, and the Tennessee Department of Transportation (TDOT) “overhead” has grown 63 percent under Governor…

Read the full storyEffort to Correct Some of The Gas Tax ‘User Fee’ Diversion From The Highway Fund Amended Away

A bill introduced to remove a portion of the diversion of fuel tax “user fees” from the Highway Fund to the General Fund was amended so drastically that the bill was rewritten so that it rewrote the bill, and instead increased the amount distributed to the Wildlife Resources Fund. As reported by The Tennessee Star, and confirmed by Rep. Susan Lynn (R-Mt. Juliet), Tennessee Code Annotated requires that portions of the “user fee” fuel taxes be allocated to the General Fund to cover the costs incurred by the state Department of Revenue for the collection of those taxes. HB 910 / SB 230 by Rep. Tim Wirgau (R-Buchanan) and Sen. Mark Green (R-Clarksville), respectively, would have “eliminated the administrative allocation of the gasoline tax, motor fuel tax, and gasoline inspection tax to the General Fund.” It would have no impact on the total collections from the various fuel taxes, but would simply allocate them to the Highway Fund rather than the General Fund. The fiscal memo for the original bill reported increases to the Highway Fund of $12 million and to local governments of $2.6 million. The bill was then completely re-written by the amendment so that the diversions to the General Fund…

Read the full storyChaos at the Capitol: Democrats’ Quid Pro Quo Education Money for Gas Tax Votes Passes, But Budget in Limbo

Thursday on the House floor, between recesses where Republicans were presumably working out their differences over parts of the budget, and working their way through a pile of amendments to HB511, Democrat Rep. Craig Fitzhugh, the House Minority Leader, went to bat for a third time to secure a pot of recurring education money to be used at the discretion of local school districts. Fitzhugh opened his remarks by acknowledging a “rumor” that the Democrats had cut a deal with Governor – gas tax votes for the education slush fund, but he denied that there was any quid pro quo agreement. The starting bid for Fitzhugh’s proposed K-12 Block Grant Act was $500 million which he admitted was “ambitious.” It was then reduced to $250 million which he admitted was also “too much.” The new amount introduced in Amendment #7 to the budget, was further reduced to $150 million, money that Fitzhugh said would go to all the state’s public schools, poor and rich alike. Appealing to his House colleagues to pass his amendment, Fitzhugh said that approving the block grant funds that would be held in a trust fund would help get around the Copeland Cap problem. Fitzhugh closed…

Read the full storyFollow The Money: Campaign Receipts May Shed Light on Why Some Republicans Voted For The Gas Tax

“Follow the money” is a catchphrase made popular in the 1976 movie, “All The President’s Men,” based on the actual events of the Watergate Break-in and suggests a money trail or corruption scheme within the political arena. While campaign receipts are no guarantee of how an elected official will vote on a particular issue, when a politician’s vote comes as a surprise to their constituents and political pundits, the behind-the-scenes world of money and power may shed light on the matter. The situation of campaign financing in the state of Tennessee is a complex web of individual and Political Action Committee (PAC) contributions and receipts to and from each other. The Tennessee Bureau of Ethics and Campaign Finance defines a PAC as a “multi-candidate politician campaign committee that participates in any state or local election. ‘Multi-candidate committee’ is defined as a committee that makes expenditures to support or oppose two or more candidates for public office or two or more measures in a referenda election. T.C.A. 2-10-102(9).” The State of Tennessee’s Online Campaign Finance webpage includes a searchable database for contributions and expenditures to candidates and PACs and from candidates, PACs, private individuals or businesses/organizations. The complexity, special interests…

Read the full storyHaslam’s Gas Tax Increase May Force Tennessee Lawmakers to Violate the Copeland Cap Amendment to State Constitution

Governor Haslam’s 2017-18 budget that incorporated IMPROVE Act and other spending promises now exceeds the constitutional budget growth limit established by the 1978 amendment to Article II, Section 24 of the Tennessee Constitution that states, “In no year shall the rate of growth of appropriations from state tax revenues exceed the estimated rate of growth of the state’s economy as determined by law.” The amendment is known as the Copeland Cap, named for its author former state Representative David Copeland of Ooltewah. The General Assembly will now be forced into a position of voting to break a constitutional commitment to the taxpayers, or appear as the “villains” by taking away the “gifts” the Governor has promised. The 2017-2018 budget estimates appropriations from state tax revenues will be $17.9 billion, which represents an 8.3 percent growth over appropriations from tax revenues in the 2016-2017 state budget at $16.5 billion. The estimated rate of growth of the state’s economy for the 2017-18 budget year, as defined by state law, is 4.6 percent over the 2016-17 budget year. The governor’s budget, as currently structured with the IMPROVE Act, will therefore violate the Copeland Cop by 3.7 percent. The relevant law, Tennessee Code Annotated (TCA) 9-4-5201 states that the basis…

Read the full storyState Rep. Tillis Responds to ‘Group That is Calling Me A Liar’ for Supporting Gas Tax Increase ‘After I Had Said Publicly That I Could Not’

Constituents of State Rep. Rick Tillis (R-Lewisburg) have a message for him after he switched from a “no” vote on Gov. Haslam’s gas tax increasing IMPROVE Act to a “yes” vote. A red and white banner questioning his truthfulness was prominently displayed just below a large billboard by the side of a major road in Lewisburg promoting his jewelry business in town. Last week, Tillis was one of the 37 Republican members of the Tennessee House of Representatives who voted in favor of Gov. Haslam’s IMPROVE Act, which will increase the gas tax by 6 cents per gallon (28 percent) and the diesel tax by 10 cents per gallon (55 percent). The bill passed the House 60-37 and subsequently passed in the Senate. On Monday, the House approved the Senate version of the bill, and it is set to become law after Gov. Haslam signs it. Tillis attempted to explain his vote switch on Monday. “The first thing to address is why I voted for it after I had said publicly that I could not,” Tillis wrote in a Facebook post on Monday. “The bill changed,” Tillis claimed. “And as far as the survey that is here on Facebook and…

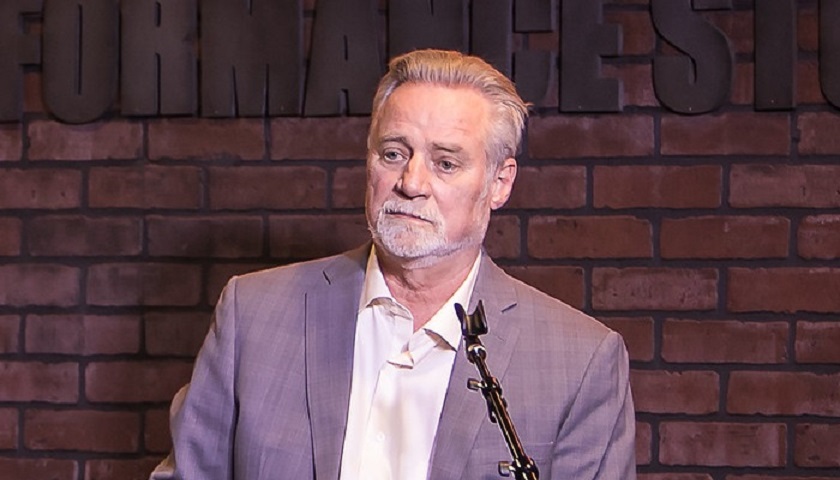

Read the full storyHouse Majority Leader Glen Casada Defends His Vote to Increase The Gas Tax

House Majority Leader Glen Casada (R-Franklin), issued a press release Monday defending his vote to increase the gas tax through Governor Haslam’s IMPROVE Act, after initially announcing on February 8 his support for the alternative Hawk Plan. The press release was forwarded via email, addressed to “Friends,” stating “I wanted to forward a statement I released to the press regarding my vote on the IMPROVE Act.” If the comments on Rep. Casada’s Facebook page responding to posts on the gas tax, the overwhelming majority of which are against the gas tax, is representative of other feedback he’s been getting, it likely prompted Casada’s need to explain his vote. The cover email continued, Though I still believe there was a better way to fund road construction for Tennessee that did not raise taxes, I did vote for the amendment that was the IMPROVE Act. My support for the alternative plan that would have shifted funds to the Department of Transportation without raising the gasoline tax died twice in committee and again on the House floor. Thus, my only option was to do nothing on road funding, or vote for the IMPROVE Act – the next best vehicle available to attain our goal of…

Read the full storyBill Lee Announces Candidacy For Governor, Calls Gas Tax Increase ‘Water Under the Bridge Now’

NASHVILLE, Tennessee–Kicking off his campaign for governor Monday, Bill Lee described himself as a Ronald Reagan-admiring fiscal and social conservative whose leadership experiences in business and agriculture compensate for his lack of political experience. Lee, who is chairman of Lee Company, a large family-owned construction, facilities and home services company, is casting himself as a conservative outsider in the race for the Republican nomination. However, Lee’s hesitant position on Gov. Haslam’s gas tax increase, which has passed both the House and Senate, is likely to disappoint conservatives who want candidates with a stronger anti-tax stance. “I’m opposed to raising taxes,” he told the media Monday morning at the Nashville Farmers’ Market, but he did not offer a definitive opinion on the gas tax increase. He said he might have handled it differently, but noted that the IMPROVE Act also included tax cuts and said the bill is “water under the bridge now.” When pressed, he said that because he wasn’t privy to all the legislative discussions surrounding the bill, he didn’t want to comment further. (You can hear the audio below.) Lee was set Monday to launch his “95 Counties, 95 Days RV Tour” with his wife Maria, a…

Read the full story6 Things Boss Doss Got Wrong In His Sales Pitch For Governor Haslam’s Gas Tax Increasing IMPROVE Act

As the House sponsor of the IMPROVE Act Tax Cut Act of 2017 (HB 534), State Rep. Barry “Boss” Doss (R-Leoma) was well versed on all of the related subject matter and respectful throughout his long and challenging sales pitch for Governor Haslam’s IMPROVE Act to the various committees and on the House floor. There were, however, several things Rep. Doss got wrong. And, as former Majority Leader Gerald McCormick (R-Chattanooga) said several times through the process, “You can have your own opinions, but you can’t have your own facts.” Here are the top six things Boss Doss got wrong: 1. “I’ve been proud that we cut taxes by $300 million so far.” The state portion of the annual budget has grown from $13.7 billion in 2011-12 to a recommended $16.5 billion for 2017-18. Since state law requires that all of the revenues be allocated, that’s a $2.8 billion, or 20 percent, increase in state spending in just six years. 2. The average family of 4 will recognize a monthly increase of $5.54 from the gas tax hike versus a savings in their food tax of $7.72, for a net savings of $2.18 per month. In terms of the…

Read the full storyHouse Republican Conservatives Put Up a Valiant Fight Against Gov. Haslam’s Gas Tax Increase, Setting Stage for 2018 Election

When the Tennessee House of Representatives passed Governor Haslam’s gas tax increase bill by a 60 to 37 margin on Wednesday, a bare majority of Republicans–37 for and 35 against—voted yes in favor of the unpopular tax increase. The 35 conservative Republicans who stood for the foundational principle of limited government were not sufficient to withstand the huge financial and political pressures mounted by the special interests who wanted the bill to pass. Those forces arrayed against the conservative opposition were significant, beginning with Governor Haslam’s taxpayer funded statewide tour that promoted a 962 road project list in all 95 counties, the support of lobbying groups numbering in the thirties, tax reductions for a select group of businesses, and a reported $250 million taxpayer funded deal for the Democrats. These conservatives lost the battle in 2017, but the war for the Tennessee General Assembly election in 2018 has just begun. The arguments made by these 35 stalwarts on the floor of the House on Wednesday will resonate throughout the state over the next year and a half. The process through the House subcommittees and committees was not without controversy including the make up of the Transportation Committee, procedural issues, breaking…

Read the full storyGame On: GOP Primary Challenger Blasts State Rep. Susan Lynn for Voting Yes on Gas Tax Increase After Saying She Opposed It

Less than 24 hours after State Rep. Susan Lynn (R-Mt. Juliet) broke her promise not to vote for a gas tax increase, her 2018 Republican primary challenger is on the attack. “In a story reported by The Tennessee Star on March 12, 2017 Susan Lynn declined a challenge by Jeremy H. G. Hayes to debate her support of the Gas Tax, saying, ‘No, I am not for the gas tax so there is nothing to debate,’ ” the Jeremy Hayes for State Representative campaign said in a statement released on Thursday. Hayes announced in February he will challenge Lynn in the August 2018 Republican primary to represent the 57th House District. In a March 12 story titled “State Rep. Susan Lynn: ‘I Am Not For The Gas Tax So There Is Nothing To Debate’,” The Tennessee Star reported: “No, I am not for the gas tax so there is nothing to debate,” State Rep. Susan Lynn (R- Mount Juliet) tells The Tennessee Star in response to challenger Jeremy Hayes’ March 8 press release calling on her to debate him over the issue. Hayes opposes Gov. Haslam’s proposed gas tax increase. As The Star reported on Wednesday, Rep. Lynn was one…

Read the full storyHaslam Bargained with Democrats and Establishment Republicans to Pass Gas Tax Increase Bill

Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017” (HB 534), which includes a 6 cents per gallon gas tax increase and a 10 cents per gallon diesel tax increase phased in over three years, garnered 23 votes from Democrats and 37 establishment Republicans, which was more than sufficient to get it to pass in the Tennessee House of Representatives by a vote of 60 to 37 late Wednesday. It was a long day for State Rep. Barry “Boss” Doss, the leading co-sponsor of the bill, who spent several hours presenting the case for the bill on the floor of the House prior to the final vote. Only two Democrats, State Rep G. A. Hardaway (D-Memphis) and State Rep. John Mark Windle (D-Livingston), joined the conservative caucus of Republicans, who cast 35 votes against the IMPROVE Act “Tax Cut Act of 2017.” Rumors swirled throughout the capitol Wednesday that Governor Haslam had made a deal with the Democrats to secure their votes. Rep. Doss (R-Leoma) was seen conversing on the floor with several Democrats throughout the day, which was not, by itself, particularly unusual. More significantly, Democratic Minority Leader Craig Fitzhugh (D-Ripley) was seen accompanying administrative staffer Warren Wells to the…

Read the full storyNashville Mayor Megan Barry Calls Passage of Gas Tax Hike ‘A Momentous Day in Tennessee,’ Looks Ahead to Mass Transit Plan

Nashville Mayor Megan Barry has been cheering Gov. Haslam’s gas tax hike for road improvements, while keeping an eye ahead toward implementing a $6 billion transit plan. Barry pushed for Gov. Haslam’s IMPROVE Act, which includes the gas tax hike, in the hours leading up to Wednesday’s action on the bill. The bill passed in both the House and Senate. After the bill passed, Barry celebrated with this tweet: Statement on passage of the IMPROVE Act to improve infrastructure & allow local option: This is a momentous day. https://t.co/mtVkjCCePm pic.twitter.com/B30v14FQCe — Megan Barry for Congress (TN-7) (@MeganCBarry) April 19, 2017 “Our most immediate need is funding,” said Barry, a Democrat, earlier this month in an interview with WSMV Channel 4. The $6 billion transit plan, known as nMotion, was adopted last year by the board of directors of the Regional Transportation Authority. The RTA is made up of Middle Tennessee mayors and Haslam appointees. Their endorsement is nonbinding but gives the plan momentum. The proposal calls for the project to be phased in over 25 years. Funding sources are still on the drawing board but would likely include tax increases. If former mayor Karl Dean’s failed 2014 Amp rapid bus…

Read the full storyGas Tax Increase Bill Passes House in 60 to 37 Vote

Governor Haslam’s IMPROVE Act, “Tax Cut Act of 2017,” which will increase the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon passed the Tennessee House of Representatives late Wednesday in a 60 to 37 vote. Thirty-seven Republicans and 23 Democrats voted yes. Thirty-five Republicans and 2 Democrats voted no. (Note: The count in the image on the right, provided in real time to The Tennessee Star by a source on the floor of the House, miscounted one Democrat as a Republican.) House Majority Leader State Rep. Glen Casada (R-Franklin) did not vote. Speaker Beth Harwell (R-Nashville) was among the Republicans who voted yes. State Rep. John Mark Windle and State Rep. G.A. Hardway were the lone Democrat who voted no. The State Senate is almost certain to pass a similar version of the bill, which will then go to Conference Committee to iron out any minor differences. Gov. Haslam is then expected to sign the final bill into law.

Read the full storyPreliminary Vote on Amendment to Adopt Gas Tax Increase Bill Passes House 61-35, Final Vote Expected Tonight

An amendment by State Rep. Charles Sargent (R-Franklin), a motion to adopt the IMPROVE Act “Tax Cut Act of 2017,” HB 534, passed the Tennessee House of Representatives Wednesday afternoon in a 61-35 vote. This was a preliminary vote prior to the anticipated final vote on IMPROVE Act “Tax Cut Act of 2017,” which is expected to come late Wednesday. Thirty-four Republicans, joined by a solitary Democrat, State Rep. John Mark Windle, voted against the motion to adopt. A full list of the 34 Republicans and one Democrat who voted no was compiled by reporters for The Tennessee Star on the scene (click at the bottom to see the second page): [pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2017/04/IMPROVE-Act-Amendment-House-Vote-4-19-17.pdf” title=”IMPROVE Act Amendment House Vote 4-19-17″] Notable among those Republicans who voted no were State Rep. Matthew Hill, State Rep. Timothy Hill, State Rep. David Hawk, State Rep. Sheila Butt, State Rep. William Lamberth, State Rep. Judd Matheny, State Rep. Jerry Sexton, and Speaker Beth Harwell. Twenty-three Democrats voted for the motion to adopt, along with 38 Republicans. Notable among those Republicans who voted yes were Majority Leader State Rep. Glen Casada, State Rep. Susan Lynn, State Rep. David Alexander, State Rep. John Ragan, and State Rep. Bill Dunn.…

Read the full storyBoss Doss Praises Radio Host Ralph Bristol During House Floor Debate for Calling Gas Tax Increase Bill ‘A Tax Cut’

State Rep. Barry “Boss” Doss (R-Leoma) praised 99.7 FM WWTN radio host Ralph Bristol on the floor of the House on Wednesday during the debate over The IMPROVE Act “Tax Cut Act of 2017” for calling the gas tax increase bill “a tax cut.” On Wednesday morning, during a live interview with Governor Haslam (who unveiled the bill in January), Bristol called the expected vote in the House on the gas tax increase proposal “a momentous day in Tennessee.” Doss also quoted President John F. Kennedy’s famous 1961 inaugural challenge to the country as a reason to vote for The IMPROVE Act “Tax Cut Act of 2017”: Ask not what your country can do for you, ask what you can do for your country. It was not immediately clear to the members of the gallery exactly how voting to increase the gas tax in Tennessee by 6 cents per gallon was the kind of patriotic sacrifice President Kennedy had in mind when he made that statement more than half a century ago. State Rep. Jerry Sexton (R-Bean Station) took exception to the comparison. Sexton questioned the connection between the reduction in Frachise and Excise Taxes for corporations to road construction. Doss…

Read the full storyOn Morning of Gas Tax Increase Vote, Haslam Jokes About Using ‘Standard’ Wattage of Lamps to Hot Box Legislators: ‘It Involves the Chains’

Hours before the Tennessee House of Representatives was scheduled to begin floor debate on his controversial bill to increase gas taxes on Wednesday, Governor Haslam joked in an interview with Ralph Bristol, host of Nashville’s Morning News on 99.7 FM WWTN, that he used ‘standard’ wattage lamps in his recent private meetings to pressure or “hot box” 15 targeted on the fence legislators. “I read a report anyway that you recently set aside some time to meet with specific House members to discuss this issue and it was described in that report as ‘hot box, meetings,” Bristol told the governor. “Now what wattage of lamp do you use for these hot box meetings, because I might need to borrow that some day,” Bristol asked. “It’s the standard. It involves the chains,” Haslam responded, attempting to make light of his pressure tactics. “I think anybody who knows me knows I’m not the hard pressure type,” he added. But conservative legislators and activists have a different view of Haslam’s efforts to pass the gas tax increase. “Governor Haslam is holding private meetings with legislators he has barely spoken to over the last several years. So this is a new level of…

Read the full storyHaslam Reduced Highway Fund Budget By 13 Percent, Grew State Budget By 20 Percent Before Proposing Gas Tax Increases

Governor Haslam reduced the Highway Fund budget by 13 percent, while he grew the State budget by 20 percent during his first six years in office. Only after he made these reductions in the Highway Fund budget did he propose the gas tax and diesel tax increases included in the IMPROVE Act when he introduced it in January 2017. From Governor Haslam’s first budget year of 2011-12 to the most recent 2016-17, Highway Fund allocations went from $867 million to $757 million, a reduction of 13 percent. HIGHWAY FUND ALLOCATIONS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated DOWN Budget $ $866,886,300 $823,104,600 $683,800,400 $792,219,800 $740,645,600 $756,856,000 -13% Sheet 54 of 656 54 of 545 54 of 542 54 of 550 54 of 558 54 of 558 Page A-22 A-22 A-22 A-22 A-22 A-22 During that same period, the state portion of the budget, excluding the unpredictable and heavily mandated federal funding, grew from $13.7 billion in 2011-12 to $16.5 billion in 2016-17, representing a 20 percent increase. STATE BUDGET IN BILLIONS OF DOLLARS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated INCREASE Billion $ $13.7 $14 $14.6 $14.8 $15.3…

Read the full storyGovernor ‘Hot Boxing’ Legislators to Get Yes Votes on Gas Tax Increase

Governor Haslam is concerned enough about the final outcome of next week’s proposed gas tax increase vote on his IMPROVE Act “Tax Cut Act of 2017” to set up a series of private 20 minute meetings with state legislators who are on the fence. In an email sent to staff assistants of fifteen members of the Tennessee House of Representatives on Wednesday obtained by The Tennessee Star, one of the governor’s administrative assistants “requested” these targeted legislators appear in “his conference room on the first floor of the Capitol,”beginning on Thursday. The purpose of these meetings appears to be for the governor to give these state legislators the “hot box” treatment. “Hot boxing” is a method of interrogation in which the person being interrogated “is locked in a ‘hot box’ – a small, hot room,” according to List Verse. In the political world, “hot boxing” usually refers to intense one-on-one pressure applied by a powerful political figure to a less powerful political figure. The treatment is delivered in an environment totally controlled by the more powerful political figure. Its purpose is to coerce the less powerful political figure to comply with the political will of the more powerful political figure.…

Read the full storyGas Tax Increase Lobbyists Begin Advertising Campaign on Ralph Bristol’s WWTN Show

Regular listeners to Nashville’s Morning News With Ralph Bristol on 99.7 FM WWTN may have noticed a new advertiser on Thursday–the Transportation Coalition of Tennessee. The Coalition is a group of 39 lobbying groups that support Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017,” the majority of which will directly benefit from the additional $10 billion in taxpayer-funded road projects. Several of the lobbying groups, such as the Tennessee County Highway Officials Association, Association of County Mayors and Tennessee County Commissioners Association, are funded by membership dues paid for by taxpayers through county budgets. Reports indicate that the ads are only being played on WWTN during Nashville’s Morning News with Ralph Bristol. Bristol has been a proponent of the IMPROVE Act “Tax Cut Act of 2017” since its introduction and continued his support in the second hour of Thursday’s show with an 8-minute “rant,” as Ralph often refers to them. The full transcript can be found here. In the third hour of the program, the one-minute advertising “spot” by the Coalition went like this: “Governor Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and at…

Read the full storyTennessee Republican Assembly Calls on Speaker Harwell to ‘Address Our Concerns’ About Boss Doss Conflict of Interest Over Gas Tax Increase

The Tennessee Republican Assembly is calling on Speaker Beth Harwell “to fulfill her oath and address our concerns” about State Rep. Barry Doss (R-Leoma) “having a conflict of interest while serving as Committee Chair for the Transportation Committee.” “On March 28, 2017, a letter from the Tennessee Republican Assembly (TRA) was hand delivered to Speaker Beth Harwell’s office. The letter contained well-defined examples of Rep. Barry Doss as having a conflict of interest while serving as Committee Chair for the Transportation Committee,” the TRA said in a statement released on Thursday. “This was an official request for a meeting with Speaker Harwell to discuss our valid concerns and it is not acceptable for Speaker Harwell to refuse to acknowledge or meet with the Board to discuss the matter, after repeated attempts to get her to do so,” the statement continued. “We are now publicly calling on the Speaker to fulfill her oath and duties and address our concerns,” the statement concluded. You can see the TRA statement here: [pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2017/04/Harwell_Doss_pr_41317.pdf”] “The Tennessee Republican Assembly has asked Speaker Beth Harwell (R-Nashville) to begin an ethics investigation of the business conduct of State Rep. Barry Doss (R-Leoma), a vocal supporter of…

Read the full storyTransportation Coalition of Tennessee Set to Air ‘It’s Smart’ Ads to Promote Gas Tax Hike

The Transportation Coalition of Tennessee (TCofTN), will launch a series of radio ads touting Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017”, the Times Free Press reports. With the legislation heading to the state House and Senate floor as early as next week, the Transportation Coalition of Tennessee plans to begin airing the 60-second spots starting Thursday, going through April 21. The $127,000 buy’s hits the Chattanooga, Jackson, Memphis, Nashville, Knoxville and Tri-Cities markets. TCofTN describes themselves in a statement announcing the ads as a coalition of “businesses, citizens, community leaders, public officials and organizations that are interested in continuing Tennessee’s transportation infrastructure for the long haul.” Their membership includes senior citizen’s insurance group AARP, auto club AAA, the Nashville Chamber of Commerce, the American Heart Association, Tennessee Road Builders Association and some 33 others. The series, called “It’s Smart,” feature spots voiced by a comforting, grandfatherly persona praising the Governor’s plan, saying: Gov. Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and, at the same time, gives a tax cut to all Tennesseans through a 20 percent tax cut on food. Listen: All the ads are available to enjoy here.…

Read the full storyWWTN’s Ralph Bristol Blasts Conservative State Representative Who Opposes Haslam’s Gas Tax Increase Bill

Ralph Bristol, host of Nashville’s Morning News on 99.7 FM WWTN, blasted a leading conservative Republican State Representative who opposes Gov. Haslam’s gas tax increase proposal, the IMPROVE ACT “Tax Cut Act of 2017,” on his program Thursday morning. Earlier this month, State Rep. Jerry Sexton (R-Bean Station) called on Speaker Beth Harwell (R-Nashville) “to hit the restart button in regards to the IMPROVE Act and to send the bill back to Transportation Subcommittee to be debated fairly and openly,” as The Tennessee Star reported. Bristol is no fan of Sexton or his opposition to the gas tax increase, and made that point very clear on his program Thursday. Recent developments “will hopefully bury Jerry Sexton in the graveyard of political one-hit blunders,” Bristol said near the end of a lengthy soliloquy in which he praised the current version of Gov. Haslam’s gas tax increase bill. The IMPROVE Act “Tax Cut Act of 2017,” he said, “is still, in my opinion, by far the most conservative plan on the table to increase funding for transportation in Tennessee.” Bristol also seemed eager to participate in the debate on the floor of the Tennessee House or Represenatives next week when the…

Read the full storyFACT’S David Fowler Praises ‘Little Guys’ In Fight Against Gas Tax

David Fowler of the Family Action Council of Tennessee has waded into the gas tax debate, writing in a blog post last week that while the issue is outside the focus of his group, it is “just too interesting to let slide.” “To appreciate what’s going on, you need to understand that the state House has always had a top-down management style,” wrote Fowler, who served in the state Senate for 12 years before joining FACT as president in 2006. “It works sort of like this,” Fowler wrote. “The Speakers typically give the rank-and-file Representatives (hereafter, the ‘Little Guys’) the freedom to represent their folks back home, so long as their views on something important don’t conflict with that of the Speaker or the Governor, to whom the Speakers for some reason seem to always take some kind of fealty oath. But when there is a conflict, the Speaker uses the loyalty of his or her committee and subcommittee chairs, engendered by their being given a position of ‘importance,’ to bring down the hammer and get the ‘preferred’ agenda rammed through.” Fowler applauds the “Little Guys” who won’t “shut up and go along” with the gas tax, part of Gov.…

Read the full storyThe 962 Road Construction Projects Costing $10.5 Billion in The Gas Tax Increase Bill Can Be ‘Modified’ by TDOT

Governor Haslam and other administration officials have stated since announcing the IMPROVE Act , now the “Tax Cut Act of 2017,” on January 18 that the purpose of the gas and diesel tax increases included in the bill is to fund 962 needed road construction projects in all 95 counties for a price tag of $10.5 billion.

These projects, however are the seventh in priority in a list of seven things for which the additional funds raised in the bill can be used.

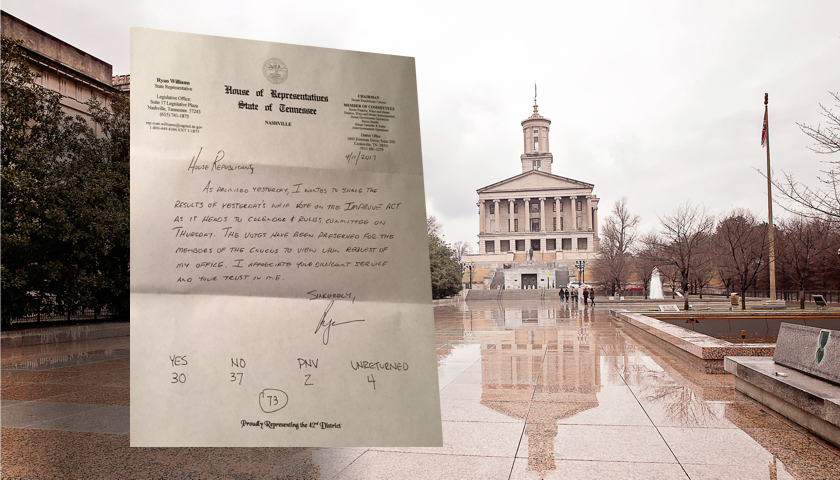

Read the full storyBREAKING: Majority of House Republicans Oppose Gas Tax Increase in ‘Secret’ Whip Vote, 37 to 30

Earlier this week the House Republican Caucus Chair Rep. Ryan Williams (R-Cookeville) conducted a secret poll of the House GOP Caucus members to gauge support for the Haslam IMPROVE Act “Tax Cut Act of 2017.” Williams distributed popsicle sticks to members of the Caucus for them to cast their votes in favor or opposition to the bill as it currently stands. The Tennessee Star has obtained a copy of the Williams vote tally, which shows a clear majority of the Caucus poised to vote against the IMPROVE Act “Tax Cut Act of 2017” that was passed out of the Finance Committee yesterday by voice vote. The “secret” vote among the Republican Caucus members revealed that there are currently 37 “no” votes, 30 “yes” votes, 2 “present and not voting”, and 4 popsicle sticks that were not returned. The GOP Caucus is currently comprised of a total of 73 House Members. Passage of the IMPROVE Act “Tax Cut Act of 2017” on the House Floor will require 50 votes. Therefore, if the numbers revealed in the secret vote tally hold, Governor Haslam will have to secure the votes of almost the entire Democratic Party Caucus to pass his tax plan,…

Read the full storyGas Tax Increase Passes House Finance Committee on a Voice Vote

Rep. Charles Sargent (R-Franklin), chairman of the House Finance, Ways, and Means Committee, presided over a voice vote on Tuesday that advanced the controversial IMPROVE Act “Tax Cut Act of 2017” to the Calendar and Rules Committee, where it awaits scheduling for a vote on the floor of the full House. Rep. Barry Doss (R-Leoma), as sponsor of the bill, once again presented the features of the IMPROVE Act “Tax Cut Act of 2017.” Doss unexpectedly made a point of saying that the renaming of the bill last week to include The Tax Cut Act of 2017 was something that was not important to him, but it was to its sponsor, Rep. Gerald McCormick (R-Chattanooga). Chairman Sargent allowed a leisurely-paced question and answer period from Committee members to Rep. Doss, which came primarily from Democrat members of the Committee. Rep. Mike Carter (R-Ooltewah) pointed out that while he wished it wasn’t included in the IMPROVE Act “Tax Cut Act of 2017”, he wouldn’t vote for a bill that didn’t include the change from the franchise and excise tax to the single sales factor due to the loss of Polaris from his district to the state of Alabama. Rep. David Hawk (R- Greeneville)…

Read the full storySteve Gill Commentary: Crony Capitalism Drives the Haslam Gas Tax Plan

The Haslam Administration is doling out over $113 million in tax CUTS to some of Tennessee’s largest corporations to justify over $350 million in tax INCREASES on working Tennesseans. According to the Times Free Press, just 24 large manufacturing companies will each receive tax breaks of over a million dollars a year under the Haslam plan. Those two dozen companies will reduce their tax burden by over $57 million and receive OVER HALF of the proposed $113 million in Franchise and Excise tax reduction. Tennessee law doesn’t allow the state to release the specific identities of the 24 companies that will benefit most from the Franchise and Excise tax cut. However, according to the Times Free Press certain companies that fit the profile of those who are most likely among the 24 sharing in the $57 million tax break include Nissan, Volkswagen, and General Motors. “This whole tax scheme appears to be built upon a foundation of special treatment for the Governor’s friends while sticking it to ordinary working Tennesseans,” according to State Rep. Judd Matheny. “Before the plan moves one step forward there needs to be full and complete disclosure of who exactly stands to benefit, and how…

Read the full story80 Percent of Speaker Beth Harwell’s Constituents Contacted by AFP Door Knocking Oppose Gas Tax Increase

Americans for Prosperity (AFP) Tennessee organized a Day of Action Saturday during which volunteers knocked on doors in Speaker Beth Harwell’s (R-Nashville) district asking constituents whether they were in favor of a gas tax increase, or wanted revenues from the $2 billion surplus to be used for funding of road projects. Shawn Hatmaker, AFP Tennessee’s Field Director told The Tennessee Star that the overwhelming majority, 80 percent in fact, of respondents said they were opposed to a gas tax increase and wanted existing revenues to be used. As her constituents, respondents were encouraged by AFP volunteers to contact Speaker Harwell to urge her to push forward with the plan she announced last week. The plan, which Speaker Harwell addressed briefly Thursday, that does not raise any taxes, but simply transfers sales tax revenues already collected on new and used vehicles from the General Fund to the Highway Fund. Respondents as well as those not at home were left with a door hanger that provided an overview of Governor Haslam’s gas tax increase plan versus Speaker Harwell’s proposal that also included contact information for her office. Ed Smith is a Heritage Action Sentinel as well as an AFP volunteer who…

Read the full storyGrassroots Activists Petition Republican Majority to Oppose Gas Tax Increase

The Tennessee Alliance of Liberty Groups, a group of grassroots activists from around the state, were motivated by two events this week that prompted the issuance of an urgent action alert to sign a petition that will go to all state legislators about the gas tax. The first event this week prompting action by the group was the renaming of the IMPROVE Act to the “Tax Cut Act of 2017” is what the Alliance calls out as “an obvious attempt to deceive Tennesseans.” As reported by The Tennessee Star, the renaming took place in the House Finance, Ways and Means Subcommittee meeting through an amendment presented by Rep. Barry Doss (R-Leoma) and authored by Rep. and House Finance Subcommittee Chairman Gerald McCormick (R-Chattanooga). The Alliance very directly points out in their letter that “the purpose of the IMPROVE Act was never to reduce taxes but was to allocate funds for roads.” The letter continues, “So, this sleight of hand by Republican legislators in renaming a road repair & construction bill to a tax cut bill is not only offensive, it is the lowest form of deception by men and women to whom we have entrusted and lent the keys to…

Read the full storyDespite Ethics Cloud, ‘Proud’ Barry Doss Presented ‘New and IMPROVED’ Gas Tax Bill for ‘Rebranding’ as ‘Tax Cut Act of 2017’

Rep. Barry Doss (R-Leoma) told the House Finance, Ways and Means Committee on Wednesday he was “proud to bring the bill before you,” as he presented Governor Haslam’s IMPROVE Act, the gas tax increase proposal he co-sponsors, for consideration. Rep. Doss continues to sponsor and present the bill, despite the call for an ethics investigation by the Tennessee Republican Assembly over potential Tennessee Department of Transportation contracts for his company. Doss statement of pride in the gas tax increase proposal came both in his opening statement and again later in response to Rep. David Hawk (R-Greeneville). Hawk said he would continue to work to “present a plan our colleagues can vote for, as opposed to presenting a plan that our colleagues may have to hold their nose and vote for.” Doss took exception to Hawk’s comments, and said again that he was proud to sponsor the gas tax increase bill and that he is “not holding my nose today.” He conceded, however, that it’s “going to take some education of our constituents,” something he said he has “been doing for a solid year.” Although he has served two previous terms in the House of Representatives, Rep. Doss has not been a member…

Read the full storyState Senator Mark Norris Accuses House Speaker Beth Harwell Of Working Covertly On Gas Tax Alternative

State Senate Majority Leader Mark Norris has accused House Speaker Beth Harwell of working behind the scenes on a plan to avoid a gas tax increase, the Chattanooga Times Free Press reports. “There’s a fine line between indecision and deception,” Norris (R-Collierville) said Thursday, who did not elaborate on his comment. On Wednesday, Rep. David Hawk (R-Greeneville) told the Budget Subcommittee that he, Harwell and others were working on alternative funding plan for Gov. Haslam’s IMPROVE Act. The amended legislation includes a gas tax hike of six cents and a 10-cent increase on diesel over the next three years, while cutting three taxes in the general fund, including the sales tax on groceries. The Tennessee Star reported Thursday that Harwell (R-Nashville) and others want to use revenues from the sales tax on new and used vehicles toward funding road projects. Harwell said details of the plan are still being finalized. Hawk’s announcement caught Republican Senate Speaker Randy McNally, Budget Subcommittee Chairman Gerald McCormick (R-Chattanooga) Gov. Haslam and others by surprise, according to the Chattanooga Times Free Press. On Wednesday, State Rep. Barry Doss (R-Leoma), chairman of the House Transportation Committee and co-sponsor of the gas tax increase proposal, presented a lengthy argument…

Read the full storySpeaker Harwell Says She Will Have a Road Funding Plan That Does Not Raise The Gas Tax

Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storyAmericans For Prosperity To Hold ‘A Gas Tax Day Of Action’ In Speaker Harwell’s District

Americans For Prosperity-Tennessee (AFP) announced ‘A Day of Action’ in the fight against the gas tax hike in the home district of Speaker Beth Harwell (R-Nashville), in order to encourage her to oppose the unpopular measure. Volunteers will be door-knocking all day Saturday, April 8 from 9 a.m. to 5 p.m. in the Belle Meade, Forest Hills and Oak Hill areas of Nashville. Full details are available on AFP’s Facebook page. The gas tax increase is the more common term applied to Governor Haslam’s IMPROVE Act – recently renamed the “Tax Cut Act of 2017” – which, in its current form, includes a 6 cent per gallon gas tax increase and a 10 ten cent per gallon diesel tax increase. The tax hikes are slated to be phased in over a three-year period to fund the Tennessee Department of Transportation’s (TDOT) list of 962 projects that currently carry a $10.5 billion price tag. Speaker Harwell has played a key role this session in the advancement of the gas tax through the Tennessee House of Representaives. At the outset of the current 110th Tennessee General Assembly, she assigned the members and picked the chairmen of the House Committees and Subcommittees including the critical…

Read the full storyDESPERATE: Laughingstock Boss Doss Renames Failing ‘IMPROVE Act’ Gas Tax Increase to ‘Tax Cut Act of 2017’

Peals of laughter echoed through the House Finance sub-committee chamber Wednesday as Transportation Committee Chairman Rep Barry “Boss” Doss (R-Leoma) moved an amendment renaming the troubled legislation increasing fuel taxes known as the ‘IMPROVE Act’ to the ‘Tax Cut Act of 2017.’ Proponents of the bill have been claiming it is revenue neutral, despite the fact that they are using tax cuts passed in previous years to balance against the huge fuel tax increases contained in the legislation aimed at increasing road funding by approximately $300 million per year. Now, proponents are rebranding the legislation again as a “tax cut” despite the fact that the primary “cuts” flow only to a few dozen large manufacturing companies. Last month, Boss Doss blatantly broke House rules to ram Gov. Haslam’s gas tax proposal – then known as the IMPROVE Act – through the House Transportation Committee he chairs. On Monday State Rep. Jerry Sexton (R-Bean Station) and 16 other members of the House called on Speaker Beth Harwell to send the bill back to the House Transportation Subcommittee for a “fair and open debate.” On Tuesday Speaker Harwell’s office told The Tennessee Star she did not have the legal authority to…

Read the full storyTennessee Farm Bureau Supports Haslam’s Gas Tax Because They Don’t Have to Pay It

Since January 2008, Tennessee farmers have benefitted from expanded agricultural tax exemptions, including sales and use taxes on “gasoline or diesel fuel used for ‘agricultural purposes’ as defined in Tenn. Code Ann. Section 67-6-102.” Farmers in Tennessee who own or lease “agricultural land from which $1,000 or more of agricultural products were produced and sold during the year, including payments from government sources,” are exempt from paying tax on “off road” use of gasoline and diesel fuels. A full year before Governor Haslam released his “IMPROVE Act” that raises the tax on gas and diesel fuel, Tennessee Farm Bureau’s (TFB) president Jeff Aiken said: “We could support a fiscally responsible state fuel tax increase, if and only if the money that was taken out of the funds under the Bredesen administration were first returned to the fund, and as long as the monies collected would go toward building and maintenance of roads and bridges in the state and nothing else.” Despite Haslam explicitly admitting that that up to $70 million of the gas tax can be spent on mass transit by cities and counties, the TFB has not withdrawn their support for the proposed fuel tax increases. In fact, last…

Read the full storyState Rep. Sexton Tells Speaker Harwell: ‘Hit The Restart Button’ On Gas Tax, Send It Back to Subcommittee ‘To Be Debated Fairly and Openly’

State Representative Jerry Sexton (R-Bean Station), joined by more than a dozen colleagues in the Tennessee House of Representatives, held a press conference Monday blasting the Republican leadership for their heavy-handed and ethically questionable tactics to ram through the Governor’s gas tax hike, the key element of the IMPROVE Act. “We are calling on Speaker Harwell, House Leadership, and those that support this bill to hit the restart button in regards to the IMPROVE Act and to send the bill back to Transportation Subcommittee to be debated fairly and openly,” Sexton announced. The Tennessee Star was there with cameras rolling: The Star has reported extensively on how State Rep. Barry Doss, Chairman of the House Transportation Committee, broke the rules of the House of Representatives to push Haslam’s gas tax through the committee. On March 22, for instance, The Star published a story titled “Boss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee,” which provided a blow-by-blow account of the subterfuge behind the bill’s passage that day. “The people have elected Republicans to govern at all levels of state government. The Republicans control the Governors Mansion, the state house, and the state senate. We,…

Read the full storyState Rep. Jerry Sexton Calls Out Hypocrisy of Gas Tax Supporters Who Oppose Use of Sales Taxes for Road Construction

Fireworks erupted on the floor of the Tennessee House of Representativesewhen the typically rapid-fire tick-tock of the day’s agenda was interrupted as Rep. Jerry Sexton (R-Bean Station) questioned Rep. Ryan Williams (R-Cookeville) on the “special privilege” of professional sports teams re-directing sale tax revenues back to a Nashville municipal organization whose purpose is to promote sporting events and sports teams. Rep. Sexton drew a strong parallel between the redirection of those funds – which Williams supports – and the redirection a small portion of sales tax revenues for the benefit of road construction, improvements and repairs – which Williams opposes. Williams supports of Gov. Haslam’s plan to raise taxes on gas and diesel to fund road construction instead. Sexton pointedly called out the hypocrisy of supporters of Haslam’s gas tax increase plan, who claim road construction can only be funded by “user fees” of those who use roads, while sports team stadiums can be funded by those who do not use or attend events at those stadiums. Sexton made his remarks during a debate “over an unrelated bill on the House floor on Thursday that would redirect sales taxes collected at a proposed Major League Soccer stadium in Nashville to be…

Read the full story