Gov. Gretchen Whitmer Wednesday night announced her Rebuilding Michigan plan to “fix the damn roads,” using an additional $3.5 billion in road funding through state road bonds without an increased gas tax.

Read the full storySearch Results for: gas tax

‘Hands-Free’ Driving, Gas Tax Increase and Other Tennessee Laws That Go Into Effect Today

The state legislature passed 513 Public Acts in the first half of the 111th General Assembly, many of which go into effect on July 1, 2019, and impact the general public like the “hands-free” driving law. The new “hands-free” law, as previously reported by The Tennessee Star, defines what it means to be “hands-free” and extends the requirement to be “hands-free” from just schools zones to all Tennessee roads and highways. In addition, a law that passed in 2017 will also be hitting Tennesseans again on July 1. Namely, the Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – IMPROVE Act, also referred to as the 2017 Tax Cut Act, will increase the tax on gasoline by another $0.01 and the diesel tax by another $0.03 effective July 1. These are the final increases to the two fuel taxes, which went up $0.06 on gas and $0.10 which went up three times starting on July 1, 2017. The tax on Compressed Natural Gas and Liquified Gas will also go up by $0.03 each on July 1, completing the $0.08 total increase over the same three years. Meanwhile, the Hall Income Tax phase out, which was one of…

Read the full storyMichigan House GOP Pushes Own Infrastructure Plan, Rejecting Whitmer’s 45 Cent Gas Tax Hike

by Tyler Arnold Michigan House Republicans unveiled an infrastructure funding plan that would divert all revenue generated from sales taxes paid on gasoline purchases to fund road improvements, rejecting Gov. Gretchen Whitmer’s plan to increase road funding through a 45-cent gas tax hike. The Republican plan would provide about $800 million annually in additional funds for roads once fully phased in, which is far less than Whitmer’s plan crafted to generate about $2.5 billion. “It’s our duty to do the best job we can to provide an effective, efficient and accountable state government with the money taxpayers already provide,” Rep. Shane Hernandez, R-Port Huron (pictured above), said in a news release. “We have gone through the budget line-by-line to find savings and set priorities that reflect what matters most to Michigan taxpayers and families,” Hernandez said. “That’s the approach we should take – rather than asking taxpayers for more money.” Currently, the sales tax paid at the pump is used mostly to fund schools and local governments, rather than roads. Hernandez’s plan would divert all of this money to infrastructure, but would do so without sacrificing money for schools and local governments. Money will be diverted back into schools and…

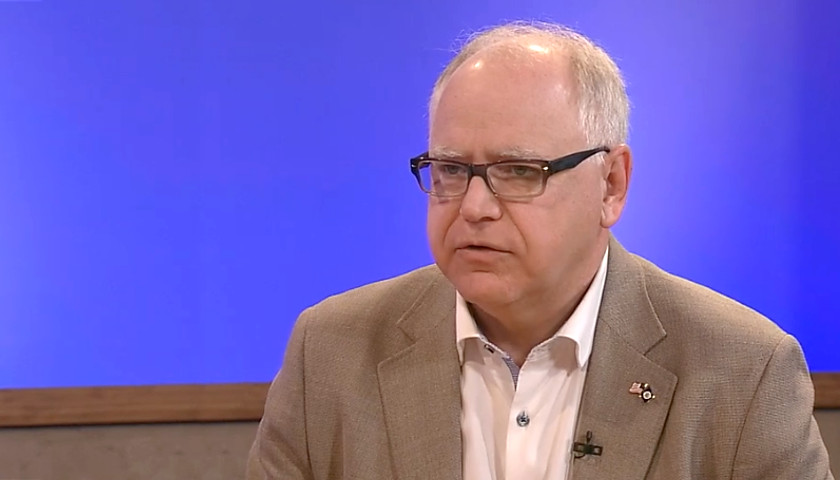

Read the full storyMinnesota Gov. Walz Says Republicans and Business Leaders Will Beg Him for a Gas Tax Next Year

Minnesota Gov. Tim Walz said he expects businesses and Republican legislators to suggest a gas tax to him next year. The governor, a member of the Democratic Farmer-Labor Party, made the remarks Friday during an interview with Mary Lahammer on Twin Cities Public TV. The Minnesota Senate Republican Caucus provided a video clip here. Hard pass. Again. ✋ pic.twitter.com/SU0QHuNGR2 — Minnesota Senate Republicans (@mnsrc) June 1, 2019 Walz said, ”I fully expect that the business community and Republicans legislators will suggest it to me.” The full interview is available here. (The gas tax discussion starts around 12 minutes and 6 seconds.) He said his proposal is not ideological but about needs. “That’s what the engineers tell us we need,” he said. It was obvious to him during negotiations that “Republicans weren’t going to do a single penny,” he said. When asked if he would revisit the tax next year, Walz made the remark about opponents coming to him. The reaction was overwhelmingly skeptical on the Minnesota Senate Republican Caucus’ Facebook video post here. In February, Center of the American Experiment criticized Walz’ planned tax hike of 20 cents per gallon of gas. So, even with a projected budget surplus…

Read the full storyNo Gas Tax Increase for Minnesota

An omnibus transportation budget bill is on its way to Gov. Tim Walz’s desk without any gas tax increase. After clearing the DFL-controlled House Friday evening, the bill passed out of the Senate later Friday night in a 54-13 vote. It’s official…no gas tax increase in Minnesota. Senate just passed transportation bill after House passed earlier. On its way to the governor. pic.twitter.com/Yk81S8lq3j — Tom Hauser (@thauserkstp) May 25, 2019 The transportation bill was one of 13 bills state lawmakers passed during their marathon 21-hour special session that wrapped up Saturday morning just before 7 a.m. “This year we drove down the cost of health care, gave tax relief to the middle class, made historic investments in education, and funded roads and bridges. This is a budget that all Minnesotans can be proud of,” Senate Majority Leader Paul Gazelka (R-Nisswa) said Saturday morning. “This year we drove down the cost of healthcare, gave tax relief to the middle class, made historic investments in education, and funded roads and bridges. This is a budget that all Minnesotans can be proud of.” #mnleg pic.twitter.com/IiBzkg1Og0 — Paul Gazelka (@paulgazelka) May 25, 2019 Sen. Scott Newman (R-Hutchinson), chair of the Senate Transportation Finance…

Read the full storyMichigan Senate’s Budget Excludes Gas Tax Proposed by Gov. Whitmer, Potential Veto

by Tyler Arnold The Michigan Senate passed a budget package that secured some additional funding for roads, but falls far short of Democratic Gov. Gretchen Whitmer’s proposed road funding and excludes her proposed 45-cent gas tax hike, which would nearly triple the tax. “We are … investing an additional $132 million entirely to local roads – fully implementing $1.2 billion from the 2015 roads plan a year ahead of schedule,” Sen. Stamas, R-Midland, said in a news release. Stamas is the chairman of the Senate appropriations committee. “Discussions can and will continue on additional funding for our roads, but we need to press forward and fulfill our other responsibilities with the resources that we currently have,” Stamas said. “It’s one of our top jobs to pass a balanced budget on time – and we owe that to all Michigan families.” Whitmer’s plan would have increased the state’s gas tax from 26 cents to 71 cents to generate $2.5 billion in revenue that would be spent fully on road funding. But her plan would have eliminated $600 million of road funding from the general revenue and diverted that money to other issues, including education and ensuring the quality of drinking…

Read the full storyPolling Continues to Show Strong Opposition to 20-Cent Gas Tax Increase

Veteran political reporter Tom Hauser was chastised in December by at least one state representative when he correctly pointed out that all but one recent poll showed opposition to a gas tax increase. Hauser said at the time that “nearly ever poll,” with the exception of one Star Tribune poll, showed that a majority or plurality of Minnesotans opposed an increase in the state’s gas tax, as The Minnesota Sun reported. He noted that “every KSTP/SurveyUSA poll in the last 15 years” found opposition to an increase. Polling has continued to confirm Hauser’s analysis. A late April poll from the Minnesota Chamber of Commerce and the Minnesota Business Partnership found that 65 percent of Minnesotans oppose Gov. Tim Walz’s proposed 20-cent gas tax hike. Now, a new poll conducted for the Center of the American Experiment by Meeting Street Research has found similar results. The poll, published in the latest issue of Thinking Minnesota, found that 60 percent of Minnesotans oppose the 20-cent increase, and 45 percent are strongly opposed. Just 35 percent of respondents said they support the increase, and an even smaller 17 percent “strongly” support it. The 20-cent increase, which was approved Monday by the Minnesota…

Read the full storyCommentary: To Avoid a Future Gas Tax, Infrastructure Must Be Rebuilt Now

by Jeffrey A. Rendall Think about it. How many times have you driven down the road and thought, ‘Gee, someone had to pay a lot of money to build this?’ Or used the restroom in a public place and pondered, ‘When I flush the toilet, where does it all go?’ Here’s thinking hardly anyone — maybe outside of a civil engineer — even gives such scenarios a second thought. Here in western civilization, everyone takes it for granted when they switch on the faucet that clean and potable water will emerge and driving over a bridge or passing through a tunnel that it won’t collapse on them. Over the years lots of smart people ensured that everything works properly for us…or they would’ve lost their jobs (and been sued!). But even the most well-conceived systems require maintenance, and they’ll eventually wear out and need replacement or expansion. The timeless creations of Ancient Rome didn’t last forever. Here in America the decay is noticeable in many places. President Donald Trump campaigned on upgrading the country’s infrastructure and made it a central pillar of his “Make America Great Again” platform. As a lifelong builder of big beautiful things, Trump appreciates the…

Read the full storyMinnesota House Approves 20 Cent Gas Tax Hike, Likely DOA in Senate

The Minnesota House approved a 20-cent gas tax increase Monday in a vote along party lines, but the proposal is likely dead-on-arrival in the Republican-controlled Senate. “We’re not going to do a gas tax. I’ve made it very clear that is not a direction we’re going to go,” Senate Majority Leader Paul Gazelka (R-Nisswa) said Monday, according to The Star Tribune. The transportation bill passed the House in a 74 to 58 vote. Under the bill, the state’s gas tax would jump from 28.5 cents per gallon to 48.5 cents, which is a 70 percent increase. The bill also included a metro-wide sales tax to help fund Light Rail, a vehicle registration tax increase, and a new vehicle tax increase. “The House DFL’s plan to raise excessive tax and fees, including a 70 percent gas tax increase, a metro area sales tax, and more expensive tab fees is reckless and will cause serious financial harm to Minnesota families,” Rep. Jon Koznick (R-Lakeville) said. “Their plan puts Minnesota drivers in reverse.” DFL legislators staunchly defended the tax increases during a Monday press conference held before the vote. “This morning we are joining Gov. [Tim] Walz in offering Minnesotans a choice.…

Read the full storyPoll Finds Minnesotans Overwhelmingly Oppose 20-Cent Gas Tax Increase

A new poll released last week by the Minnesota Chamber of Commerce found overwhelming opposition to an increase in the state’s gas tax. The poll, conducted in conjunction with the Minnesota Business Partnership, discovered that nearly two-thirds of voters statewide oppose Gov. Tim Walz’s proposed 20-cent gas tax hike. The results of the poll show that 65 percent of respondents oppose the increase, while 54 percent are “strongly” opposed. Those numbers are even higher for Greater Minnesota respondents. Seventy-five percent of those surveyed in Greater Minnesota oppose a 20-cent increase, and 63 percent said they were strongly opposed. That’s compared to 57 percent of Twin Cities respondents who said they were opposed, while 40 percent in the metro area support the increase. As an alternative, 64 percent of Minnesotans said they are in favor of dedicating the auto parts sales tax to the transportation budget. Minnesota’s gas tax is currently the 24th highest in the country, and was last raised in 2008. A poll from The Star Tribune in October found that 56 percent of Minnesotans actually support a gas tax increase. That poll, however, asked about a 10-cent increase, as opposed to the 20-cent increase mentioned by the Minnesota…

Read the full storyCommunities Brace for Diesel Tax Increases After Ohio Gov. DeWine Signs Gas Tax Into Law

In one of his first major acts in office, Gov. Mike DeWine (R-OH) signed into law the state’s first gas tax increase since 2005. The issue has been the focal point of his first few months in office, and negotiations with House and Senate Republicans have not been easy. But on Tuesday, all parties finally agreed to a compromise: 10.5 cents on regular fuel, and 19 cents on diesel. That will bring the total gas tax to 38.5 cents, and the total diesel tax to 47 cents, both of which are currently taxed at an equal rate of 28 cents. The increase, set to go into effect July 1, doesn’t seem to have the support of most Ohioans, especially those who rely on diesel fuel. “Diesel fuel powers our economy, because it’s what the trucks that deliver Ohio-made products to market run on. A 19 cent increase on diesel will move Ohio well past the state average of 30.2 cents of tax per gallon and leave us with the sixth highest tax rate on diesel fuel in the country. This does not make Ohio more competitive and will be damaging to Ohio’s economy and to our businesses,” the Ohio Chamber…

Read the full storyGas Prices Spike as Ohio Legislature Approves Gas Tax Hike

The American Automobile Association (AAA) announced Monday that only three months into 2019, the nation’s average gas price has spiked by almost 45 cents. Ohio prices increased as well, but by slightly less than the national average. While Ohioans may be relieved, experts are predicting that these price increases are expected to continue indefinitely. According to AAA, the current average gas price is $2.69 for regular unleaded gas. Though this is far from the historical high of $4.16 in May of 2011, it’s still more expensive than gas has been in the previous three years. At the state level: The nation’s top 10 largest weekly increases are: Florida (+13 cents), California (+12 cents), Indiana (+11 cents), Georgia (+11 cents), Idaho (+9 cents), Kentucky (+9 cents), Washington (+9 cents), Oregon (+8 cents), Nevada (+8 cents) and Ohio (+8 cents). “Three months ago motorists could find gas for less than $2.50 at 78 percent of gas stations. Today, you can only find gas for that price at one-third of stations, which is likely giving sticker shock to motorists across the country,” AAA spokesperson Jeanette Casselano said. “Gasoline stocks have been steadily decreasing since early February causing spikes at the pump that are likely…

Read the full storyOhio Conference Committee Fails to Reach Deal on Gas Tax, Cancels Monday Meeting

The Ohio Legislature failed to agree on a transportation budget before its midnight deadline Sunday. While several items were agreed to, a comprise hasn’t yet been reached on the gas tax. As The Ohio Star reported, the Ohio House and Gov. Mike DeWine settled on an 11-cent gas-tax increase, seven cents down from what DeWine initially proposed. “I’m pleased that we have reached an agreement with the Speaker of the House on the transportation budget that will enable the Ohio Department of Transportation to improve and maintain safer roads, bridges, highways, and intersections across Ohio. I am hopeful that the Senate agrees to this plan as well,” DeWine said in a statement after the agreement was announced. But the Ohio Senate is opposed to the 11-cent figure, and previously passed a bill that would institute a six-cent hike. A joint conference committee composed of six members has been meeting since Wednesday, but failed to reach an agreement. Senate President Larry Obhof (R-Medina) has been relatively quiet on the matter, but spoke with reporters Friday about the negotiations. “We will continue conversations and will all be back on Monday or Tuesday of next week. So I think it’s just a matter…

Read the full storyOhio Senate Breaks Even Further from Governor DeWine, Lowering Gas Tax to Six Cents

The Republican-held Ohio Senate joined Republicans in the House of Representatives in opposing Gov. Mike DeWine on his proposed gas-tax hike. House Bill 62 (HB 62), the 2020-21 Ohio transportation budget, first proposed by DeWine on Feb. 12, originally called for an 18 cent increase to the current gas tax. This was the first major bill proposal of his term. He called the measure “a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” In his State of the State address, as well as in other forums, he maintained that this was the absolute lowest the tax could be and would have to go into effect immediately. After being referred to the House, the Republican-held legislature broke significantly from the governor, lowering the rate to 10.7 cents and ordered it to be phased in over three years. “If they pass the House bill, we’re going to end up with the worst of all worlds,” DeWine said in response. He was insistent that the 18 cent number was the only acceptable rate. While DeWine seemed hopeful he could convince the legislature to return to his 18 cent number, the Ohio Senate seems to be making it clear that 18…

Read the full storyFormer Congressman Renacci Calls for Smarter Government Spending During Forum on Gas Tax

Ohio’s Future Foundation Chairman and former Congressman Jim Renacci hosted a forum on the gas tax Monday evening with Greg Lawson of The Buckeye Institute and Paul Lewis of the Eno Center for Transportation. Gov. Mike DeWine (R-OH) has been pushing for an 18-cent gas tax increase, which Monday night’s panelists think might be too high. Although a controversial subject, the panelists were in agreement on one thing: the state government needs to be smarter with how it spends its money. “I think the real opportunity is to focus on trying to make our transportation institutions more efficient and a lot of that has to do with investing smartly, not necessarily focusing on big, expansive projects, but more doing the things that voters are actually looking for, which is roads that are well maintained, buses that run on time—kind of the run-of-the-mill stuff that isn’t as exciting as a new highway or some kind of new big project, but it’s the thing that people care about everyday. It’s really kind of focusing on asset management and taking better care of what we have,” Lewis said. Lawson agreed with the sentiment, and encouraged politicians not to get “hung up” on the…

Read the full storyOhio Governor DeWine Blasts Republican Controlled House for Lowering Gas Tax Proposal

Governor Mike DeWine aggressively condemned his fellow Republicans Monday for not supporting his gas tax increase in a candid interview with the Cleveland Plain Dealer Editorial Board. During the interview, he accused them of outright endangering the safety of Ohioans statewide by not supporting his plan. DeWine, in one of his first major bills proposed to Ohio legislature, chose to introduce House Bill 62 (HB 62), to the 2020-2021 transportation budget. Starting off his tenure as a Republican Governor with a tax increase was inevitably going to give many Republicans pause. However, this initial hesitation was greatly compounded by the fact that there are no tax offsets to the hike. In addition, the tax increase will not be gradually phased in over several years, as similar tax increases often are, but will into effect immediately. Lastly, the tax will be indefinitely pegged to the Consumer Price Index which could potentially see the tax increase every year. This is a tough pill to swallow for many Ohio Republican legislators. Conversely, DeWine is accurate when he notes the dire state of roads and bridges in Ohio. As previously reported: A 2018 study gave the state’s infrastructure an “A-” while the national state average came in at a “D+.”…

Read the full storyDeWine Sends ODOT Director to Senate to Lobby for 18-Cent Gas Tax

COLUMBUS, Ohio – The Ohio Senate Transportation, Commerce, and Workforce Committee began hearing testimonies Monday on Gov. Mike DeWine’s demand for an 18-cent gas-tax increase. The chairman of that committee, Sen. Rob McColley (R-01) (pictured, left), however, made it clear that he and his fellow Senate Republicans oppose the 18-cent figure, and even suggested an income-tax cut to offset a gas-tax increase. But Ohio Department of Transportation (ODOT) Director Jack Marchbanks (pictured, right) said Monday during his testimony that anything less than 18-cents wouldn’t cut it, and claimed that the smaller gas-tax increase of 10.7-cents passed in the House’s version of the transportation budget last week “falls far short of Ohio’s real need.” “As you may recall, due to flat revenues, highway construction inflation, and mounting debt payments, ODOT is in jeopardy of being unable to fulfill its mission to maintain the state’s most valuable physical asset: our state highway system. The credit cards are maxed out and the long-term health of Ohio’s transportation system is now at stake,” Marchbanks said. He argued that an 18-cent increase is necessary because the “state has avoided making the difficult decision to find a long-term solution to our transportation revenue shortfall for more…

Read the full storyAmericans for Tax Reform Urges Ohio to Reject ‘Straight-Up’ Gas Tax Increase

Grover Norquist, President and Founder of the nationally recognized Conservative taxpayer advocacy group Americans for Tax Reform (ATR), implored Ohioans Friday to reject the “straight up” gas tax currently being considered by the Ohio Legislature. In an open letter, Norquist warned; A gas tax hike does the greatest harm to households who can least afford it. Coupled with gas tax prices that have been creeping up in Ohio, a gas tax hike would have especially adverse effects on the state’s lower income earners. Additionally, the 2003 gas tax increase failed to meet revenue projections. Also consider that a state gas tax increase would counteract the benefits of federal tax reform and eat into Ohio taxpayers’ federal tax cut savings. This is one of the reasons why Congress has declined to raise the federal gas tax, despite pressure for them to do so. The bill has been a source of significant controversy, forcing a schism between many Ohio Republican legislators and the Ohio Republican Governor, Mike DeWine. While there is an overwhelming consensus that something must be done to address the rapidly decaying roads and bridges in Ohio, how best to fund these repairs is still up for debate. When DeWine first introduced House Bill 62 (HB…

Read the full storyOhio Lawmakers Considering A Gas Tax Increase Hear Testimony About Tennessee’s Gas Tax Increase Signed into Law in 2017

COLUMBUS, Ohio – As Ohio lawmakers consider the call by newly-inaugurated Governor Mike DeWine for an increase in motor fuel taxes of 18 cents per gallon on both gas and diesel, both the state House and Senate have heard testimony on the matter. One of the witnesses providing testimony used Tennessee’s 2017 passage of Governor Bill Haslam’s gas and diesel tax increasing IMPROVE Act – Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – as an example of a gas tax increase successfully implemented over the past several years. American Association of State Highway and Transportation Officials (AASHTO) is a non-profit, non-partisan association representing highway and transportation departments in all 50 states plus the District of Columbia and Puerto Rico, according to its website. “Its primary goal is to foster the development, operation, and maintenance of an integrated national transportation system,” representing all transportation modes including air, highways, public transportation, active transportation, rail and water. Jim Tymon, Executive Director of AASHTO since January 2019, submitted a written copy and presented verbal testimony at the Ohio State House Finance Committee earlier this week, and to the Ohio State Senate Transportation, Commerce and Workforce Committee the following day. Tymon’s nine-page…

Read the full storyFederalism Committee Chair John Becker Gauges Gas Tax as Ohio Statehouse Battle Ignites

COLUMBUS, Ohio — The battle over a gas tax increase has officially kicked off in the Ohio Statehouse. Since taking office, Ohio Republican Gov. Mike DeWine has insisted that a gas tax was critically necessary to preserving and repairing the state’s decaying roads and bridges. Though many in the state on both sides of the political aisle agreed that some form of revenue increase would be necessary, the real question was exactly how much would the increase would be. In his State of the State Address on Tuesday, as previously reported, DeWine explicitly stated that his proposed gas tax increase of 18 cents was lowest it could go: “Members of the General Assembly, by requesting $1.2 billion dollars to fill the budget hole and meet existing needs, let me assure you that I am taking a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy. He intended for it to go into effect immediately with no tax break offsets, and would peg it to the Consumer Price Index (CPI), thereby ensuring it would increase over time as the economy grew. However, prior to that speech, Ohio Republican State Speaker of the House Larry Householder…

Read the full storyDeWine Breaks from Republicans on Gas Tax

COLUMBUS, Ohio–In Tuesday’s State of the State Address, Ohio Republican Governor Mike DeWine made it very clear he would not back down on the 18 cent gas tax, leaving many state Republicans in a complicated position. In his Address, DeWine made it clear that, not only was the gas tax absolutely necessary but that an 18 cent per gallon increase (generating an additional $1.2 billion per year) was also the bare minimum necessary to address the needs of the state. “Our local jurisdictions and the state have a combined shortfall this year and for years into the future of at least $1.2 billion dollars per year. It will take this much additional revenue just for us to maintain our roads in their current condition and do only a modest amount of new work,” DeWine said. “Members of the General Assembly, by requesting $1.2 billion dollars to fill the budget hole and meet existing needs, let me assure you that I am taking a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” Despite his assertion that this is as low as the hike can be, a senior legislator from his…

Read the full storyMichigan’s Democratic Governor Pushes for an Enormous Gas Tax Increase

by Chris White Democratic Michigan Gov. Gretchen Whitmer is proposing what some opponents are calling a draconian gas tax increase to fix the state’s crumbling road infrastructure. Whitmer’s budget proposal will include a 45-cent gas tax increase, which would be phased in over three separate intervals, the governor’s spokeswoman Tiffany Brown told reporters Monday. The rate would begin increasing in October, hit its second phase in April 2020, and ease into its final phase by the end of that year. The increase is expected to generate roughly $2 billion a year in additional revenue for roads, according to media reports. Whitmer, a Democrat who ran on fixing Michigan’s roads, will present her idea to lawmakers Tuesday during a joint meeting of the House and Senate appropriations committees. Whitmer’s plan would make Michigan one of the highest fuel tax rates in the country, behind the likes of California and Pennsylvania. Michigan motorists currently pay 26.3-cent per gallon. Total at-pump costs in the state are already the sixth highest in the nation, in part because Michigan applies its 6 percent sales tax to fuel purchases. Michigan Republicans have mixed feelings about such an increase. Michigan Republican Party Chair Laura Cox panned…

Read the full storyOhio House Finance Committee Makes Its Own Road Funding Proposal of 10.7 Cent Gas Tax Increase Phased in Over Three Years, No Indexing

COLUMBUS, Ohio – After more than an hour and a half delay waiting for the substitute bill to be prepared, House Finance Chairman Scott Oelslager (R-District 48) called the meeting to order and presented the Fiscal Year 2020-2021 proposed Ohio Department of Transportation (ODOT) Budget under HB 62. The Transportation Budget, as presented by Oelslager (pictured above), would include an increase of 10.7 cents per gallon on gasoline and 20 cents per gallon on diesel. There would be a three-year phase-in on both increases as follows: Gasoline 5 cents in October 1, 2019 3 cents on October 1, 2020 2.7 cent on October 1, 2021 Diesel 10 cents on October 1, 2019 6 cents on October 1, 2020 4 cents on October 1, 2021 And, it was noted, “This increase will not be indexed,” with the emphasis included in the hard-copy document distributed to the Finance Committee members. The document also reported that the increases in the state motor fuel taxes, once fully phased in, will yield approximately $872 million. The current split of 60/40 between ODOT and local governments will be maintained. The proposal includes new registration fees for electric and hybrid vehicles, at $200 and $100, respectively. Compressed…

Read the full storyColumbus Democratic Mayor Backs Governor DeWine’s Gas Tax

COLUMBUS, Ohio– In a statement made via a Facebook Video, Columbus, Ohio’s Democratic Mayor Andrew J. Ginther announced that he is backing DeWine’s 18 cent gas tax hike. The mayor said he is backing the bill because: It will help us increase our funding for infrastructure in Columbus neighborhoods by 19 million a year. We think that’s worthwhile because we know infrastructure is really about people; opening up jobs and opportunities for others in the community to share in our prosperity. House Bill 62 (HB 62), which would create the transportation budget for the 2020-2021 biennium, includes the 18 cent gas tax increase and is currently being reviewed by the House Finance Committee. Governor DeWine made the case Tuesday in his State of the State Address for the necessity of the bill, stating: Mr. President, Mr. Speaker, Members of the General Assembly—our families should not be driving on roads that are crumbling and bridges that are failing. I appeal to you—as legislators, as fathers and mothers, as sons and daughters—help us fix this! The state has avoided its responsibility for too long—and now is the time to act. As previously reported, 30 percent of all roads are in “poor or mediocre condition.” DeWine dedicated almost half of his hour-long address to…

Read the full storyStokes Nielson’s Tweet On New Podcast Questioning Possible Senate Hopeful Bill Haslam’s Gas Tax Goes Viral

Stokes Nielson’s tweet about his podcast, “The Spirit of Humanity,” which raises questions about former Governor and possible U.S. Senate hopeful Bill Haslam relative to gas tax increases, goes viral with over a half million impressions within hours of its pre-release. As reported by The Tennessee Star, Stokes launched a new issue advocacy initiative called Stokes For Tennessee Freedom to provide a two-way dialogue on issues that could impact Tennessee citizens. Stokes’ first podcast of the new initiative, “The Spirit of Humanity,” was launched through Stokes & Friends on the Westwood One Podcast Network and featured international sensation Korean-born BTS, the “biggest new force in pop” according to Spotify, Dua Lipa, South Korean boy-band Day6, Chinese-Canadian actor, single and songwriter Kris Wu, and country superstar Tim McGraw. In a press release about the podcast, Stokes said that, per his normal practice, he tweeted out the podcast episode to his followers in a pre-release on Tuesday, February 26. Within hours, the tweet had gone viral with nearly 600,000 impressions, which “propelled the episode immediately into the Top 100 of Apple Music Podcasts,” reported Stokes. According to the award-winning songwriter and producer, Stokes, when he inadvertently encountered a fiery street protest in…

Read the full storyOhio Department Of Transportation Introduces Comprehensive Gas Tax that Could Increase Every Year

Friday, Ohio Department of Transportation Director Jack Marchbanks formally introduced the proposed 2020-21 Biennial Budget. House Bill 62 (HB 62), the budget’s formal designation, includes an 18-cent gas tax increase. While lower than some reports have suggested, the proposed tax will give Ohio one of the highest gas tax rates in the country. In addition, it contains a provision that could raise gas taxes even higher in the coming years. The 18 cent tax would go into effect immediately upon passage. When measured against other states, this is an exceptionally aggressive approach. When Nebraska voted to raise its takes, it did so in increments of 1.6 cents per year. A more incremental approach could ensure Ohioans don’t face “sticker shock” at the pump. The bill would also tie the gas tax rate to the Consumer Price Index (CPI). At the start of every fiscal year, the tax will be reexamined and if the CPI has increased, the tax will increase with it. While it would ensure that road repair is adequately funded, there is a significant drawback. As written, the law does not stipulate that the gas tax would decrease, should the CPI decrease. if the Ohio economy faces a sudden hardship or enters a recession, Ohioans would…

Read the full storyOhio Governor DeWine to Announce Gas Tax Hike

At an annual forum sponsored by the Associated Press, Ohio Republican Gov. Mike DeWine announced Wednesday he intends to formally recommend raising the current gas tax. The recommendation will come as he introduces his first two-year transportation budget Friday. Despite appointing an Advisory Committee on Transportation Infrastructure Issues specifically to explore alternative solutions to simply raising the gas tax, the governor made it clear he felt there was no real alternative. He did make a point to say the hike is “just to keep us where we are today and with the ability to do some safety projects that absolutely need to be done.” It can be inferred from this statement that his intention is to raise the gas tax enough to not let the state’s road and bridge repair funding deficit get worse than it currently is. This suggests that the tax hike would be more modest relative to addressing the full scope of road and bridge repair needed in Ohio. Currently, there is a $1 billion gap in funding. The current state tax on gas in Ohio is 28 cents per gallon. However, when combined with federal and local taxes, the total amount climbs to just about 46.5 cents per gallon.…

Read the full storyGovernor DeWine Accelerates Gas Tax Planning with No Limits Set

It’s safe to say that when Ohio Governor Mike DeWine appointed his “Governor’s Advisory Committee on Transportation” to develop solutions for paying for road and bridge repairs, citizens were hoping they’d come up was some creative answers. Instead, the committee reached a consensus last week that the primary means by which road repairs would need to be funded would be through raising gas taxes. During a meeting with the Canton Repository Editorial Board, Governor DeWine made it clear that he would be taking their advice. He noted that not only was raising the gas taxes essential to fixing the problem but that he couldn’t put a number on how high the hike would be. When asked how much the raise could be per gallon, he stated: Well I’m not going to talk about it yet. I’m not going to put a number on it…Just to maintain status quo, we’ve got to come up with $1.5 billion a year. So how we do that? I’ve been in discussions with the members of the leadership of the legislature of how to do that. Just doing the numbers, significant amount of that has to come from the gas tax. Many advocates note that there will never…

Read the full storyDeWine Appointed Committee Recommends Gas Tax Hike for Ohio

After two meetings and two hours of public testimony, the Governor’s Advisory Committee on Transportation has, so far, agreed on only one thing to save Ohio’s roads and bridges: raise taxes. As previously reported, the committee was officially launched on January 31st. Hand-picked by Governor Mike DeWine, the bipartisan committee of industry leaders, advisers, and infrastructure experts was assigned the review the current infrastructure needs and explore creative and unique solutions. While they have yet to make their final report, these initial findings are sure to disappoint many of DeWine’s voters, should they be adopted. The current gas tax was set at 28-cents-a-gallon on July 1st, 2005. These revenues are intended to directly fund the maintenance, repair, and expansion of roads and bridges throughout the state. Over time, two primary factors have greatly diminished their ability to do so. The first is that, as cars have become more efficient and achieve higher miles-per-gallon, revenues have decreased. In addition, the higher demand and proliferation of electric vehicles has had an effect that will significantly increase over time. Until this problem is addressed, the more ubiquitous electric cars become, the harder it is to maintain the roads all drivers use. The second factor is…

Read the full storyMacron Bails on Climate Summit as France Melts Down Over High Gas Taxes

by Chris White French President Emmanuel Macron made his way back to France Sunday as protesters turn the streets of Paris upside down over sky-high gas taxes designed to fight global warming. Officials are considering declaring a state of emergency to deal with the unrest. Macron returned from his trip in Argentina to chaos in the streets as so-called “yellow jacket” demonstrators continued protesting against taxes and Macron’s perceived indifference toward everyday citizens. Prime Minister Edouard Philippe canceled plans to attend a climate change summit in Poland. One person died outside Paris during the weekend’s protests, bringing the number of casualties to three. More than 260 people were arrested, including 133 in Paris, according to police reports. More than 412 people were arrested nationwide. Christophe Castaner, France’s interior minister, told reporters Sunday he would not rule out the president’s declaring a state of emergency. Macron has emergency powers that were expanded after terrorist attacks roiled the country in 2015 — it is not yet clear if he will exercised those powers. Saturday and Sunday’s protests drew roughly 136,000 people, slightly down from the 166,000 who gathered in late November, the Interior Ministry said in a press statement. Politicians and police officials believe the situation was…

Read the full storyDemocrat Gubernatorial Candidate Karl Dean Calls for Higher Gas Taxes

Democratic Party candidates in California are starting to distance themselves from a 12 cent a gallon gas tax increase imposed on drivers in their state and which is subject to a repeal effort this Fall. At least 4 Democrat candidates are turning against their own party on the issue of increased gas taxes. But in Tennessee, Democrat gubernatorial candidate Karl Dean is not only embracing last year’s IMPROVE Act fuel tax increase that raised gas and diesel taxes over $300 million a year, he wants to allow local governments to raise the fuel taxes even higher. Dean, a former two-term mayor of Nashville, says the state needs to expand on the IMPROVE Act, the 2017 law that increased gas taxes 6 cents a gallon and diesel taxes 10 cents per gallon. The tax increase was passed while Tennessee enjoyed about a $2 billion dollar SURPLUS. The phased in gas tax increase went up another one cent per gallon on July first. The final cent in the six cent increase goes into effect July 1, 2018. “Unlike my opponent,” Dean said in endorsing local option fuel tax increases, “I believe passing the IMPROVE Act was the right move for Tennessee. But…

Read the full storyTennessee Gas Tax Revenue Pays for Work on Private Property

Members of the Grundy County Highway Department used some of the Tennessee gas tax revenue to work on other people’s private properties, and that’s against state law, according to a state audit released Thursday. One of those properties was a farm where the highway superintendent kept cattle — even though he didn’t own the land. This work, which included bulldozing stumps, among other things, went on for nine years, Comptrollers said. “The highway superintendent did not lease the farm nor did the owner charge him rent on the farm for the period he has used it,” according to the audit. “The highway superintendent stated that he began using the farm when he purchased the individual’s cattle.” Highway Department employees also bulldozed a wooded area at another farm. The owner of that property, Comptrollers went on to say, was acquainted with the highway superintendent. Comptrollers said they didn’t know if the property owner paid the highway superintendent for the work. Grundy County Mayor Michael Brady told The Tennessee Star he only learned of the findings Thursday morning. “It’s a mayor’s job to be a good steward and be compliant with Grundy County’s assets and funds,” Brady said. “I’m sure the county…

Read the full storyGas Tax-Supporting Tim Wirgau Goes Down to Defeat in State House District 75

Political newcomer Bruce Griffey defeated gas tax increase-supporting State Rep. Tim Wirgau in State House District 75 Republican primary Thursday night, 58 per cent to 42 percent. The final results, as reported by The Tennessee Secretary of State’s office, were: Bruce I. Griffey 6,380 58.39% Tim Wirgau 4,547 41.61% Wirgau was not the only gas tax increase supporter to lose last night. State Rep. Barry “Boss” Doss (R-Leoma) was defeated by political newcomer Clay Doggett in State House District 70. As The Tennessee Star reported, Wirgau also voted in favor of granting in-state tuition to illegal aliens. In other notable primary races in the Tennessee General Assembly, Brandon Ogles won the State House District 61 Republican primary to replace retiring State Rep. Charles Sargent (R-Franklin), defeating attorney Gino Bulso, who finished in second place. Jeff Ford took third place and conservative activist Rebecca Burke finished in fourth place. The final results, as reported by the Tennessee Secretary of State’s office were: Candidate Votes % Brandon Ogles 3,913 35.45% Gino Bulso 2,685 24.33% Jeff Ford 1,876 17.00% Rebecca Ann Burke 1,604 14.53% Robert Hullett 709 6.42% Terrence A. Smith 250 2.27% Other primary winners included Dr. Brent Moody, who won the GOP…

Read the full storyCalifornia Voters Prepare To Square Off Against Gov. Jerry Brown Over Gas Tax Repeal

by Chris White Gov. Jerry Brown is leaving office after the midterms, but the California Democrat plans on engaging in one last brutal campaign to defend an extremely unpopular gas tax he approved in 2017. Brown is pledging to raise $25 million in a campaign to fight the repeal effort. He is also soliciting help from business and labor leaders, who view the gas tax as an instrument to build up California’s roads. Supporters of the repeal are eager to knock it around with the 80-year-old governor. “This has nothing to do with taxes,” Brown said of Prop 6, which seeks to repeal a gas tax the governor passed in April 2017. “This is engineered by the Republican congressional delegation to prop up their vulnerable Republicans,” he said in a June 6 interview with The New York Times. The Road Repair and Accountability Act imposes a 12-cents-a-gallon increase on Californians and raises the tax on diesel fuel by 20 cents a gallon. It also implements an additional charge to annual vehicle license fees ranging from $25 to $175 depending on the car’s value. The measure gained has become a hot-button issue in the Golden State. California currently ranks seventh highest in the country when it…

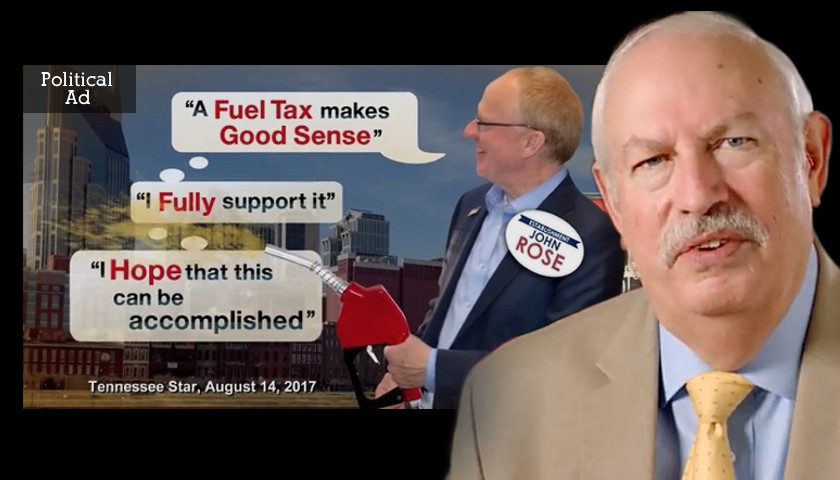

Read the full storyTennessee 6th Congressional District: Robert Corlew Hits John Rose for Supporting Huge Tennessee Gas Tax Increase

A massive gas tax increase that was part of the Haslam Administration’s IMPROVE Act, which raised fuel taxes over $300 million a year, is becoming an issue in the 6th District Republican Primary congressional race. Former judge and conservative businessman Bob Corlew is hitting fellow Republican contender John Rose for supporting the huge tax increase in a new digital ad that may soon find its way to broadcast and cable outlets in the district. According to a Corlew campaign spokesman, the ad was rejected by “Gas Station Television” because, as a representative at Gas Station Television told the campaign, “they didn’t want to run anything that would shine ‘a negative light on the gas space (or oil industry).’ So this ad never got to run on their air.” A transcript of the ad: “HEY! HEY YOU PUMPING GAS! DO YOU THINK YOU PAY TOO MUCH AT THE PUMP? WELL, IF JOHN ROSE HAD HIS WAY YOU WOULD BE PAYING MORE EVERY TIME EVERY TIME YOU FILL UP. THAT’S RIGHT, JOHN ROSE SUPPORTED INCREASING FUEL TAXES BY 33%. JOHN ROSE SAID YOU PAYING MORE EVERY TIME YOU PUMP GAS ‘MAKES GOOD SENSE’. AND ‘I HOPE THIS CAN BE ACCOMPLISHED.’ JOHN ROSE:…

Read the full storyGas Tax Increases Another 1 Cent Per Gallon Today Thanks to Gov. Haslam, Democrats, and ‘Moderate’ Republicans

The state gas tax increased another 1 cent per gallon today, thanks to the IMPROVE Act passed by Democrats and “moderate” Republicans in the Tennessee General Assembly and signed into law by Gov. Bill Haslam in May 2017. The controversial law raised state gas taxes by 6 cents per gallon and diesel taxes by 10 cents per gallon. The gas tax increases were phased in over three years. The first 4 cents per gallon increase went into effect on July 1, 2017. An additional 1 cent per gallon gas tax increase goes into effect today, and the final 1 cent per gallon gas tax increase goes into effect July 1, 2018. The law was deemed necessary to fund road construction by Haslam and his allies despite the fact the state of Tennessee had a $2 billion surplus at the time it was passed and signed into law. One under reported element of the law at the time was a provision that allowed the twelve largest counties in the state to hold local referendums to increase local taxes to fund transportation projects. It was this provision upon which former Nashville Mayor Megan Barry relied when she introduced her $9 billion transit…

Read the full storyDemocrat PAC Uses Fear Mongering and Deception to Malign Conservative Legislators, Praises Governor Haslam On Gas Tax Increase

LEBANON, Tennessee – A newly launched Political Action Committee (PAC) commissioned a billboard with a scandalous message attacking two conservative middle Tennessee lawmakers, former State Senator Mae Beavers (R-Mt. Juliet) and current State Senator Mark Pody (R-Lebanon), for their votes against Governor Haslam’s gas tax increasing IMPROVE Act. The IMPROVE Act – Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – also dubbed “2017 Tax Cut Act,” passed the Tennessee General Assembly in April 2017. On the eve of the next installment of the IMPROVE Act’s additional $0.01 per gallon gas tax and $0.03 per gallon diesel tax increases set to go in effect on July 1, 2018, and nearing the highpoint of election season, the billboard appeared on the northbound side of Highway 109 in Wilson County. Beavers is running in a hotly contested race for Wilson County Mayor against eight-year incumbent Randall Hutto. Meanwhile Pody is seeking re-election to the District 17 State Senate seat encompassing Wilson County which was vacated by Beavers when she decided to run for Governor. Pody, a sitting State Representative at the time, narrowly won the seat against Democrat opponent Mary Alice Carfi in a special election held in late 2017…

Read the full storyChallenger Shane Disputes State Rep. Susan Lynn’s Defense of Her Vote for the Gas Tax Raising IMPROVE ACT

Conservative businessman Aaron Shane, a Republican candidate for State Representative in the 57th District has called for current State Rep. Susan Lynn (R-Mt. Juliet) to explain her support of the gas/diesel/registration tax increase (Improve Act) that raised fuel taxes and car registration fees by $350 million per year. “Prior to her casting her vote raise taxes on Tennessee families, Lynn promised she would not support the tax increase, and even boasted that the funding for the expansion of Highway 109 was already approved and didn’t need the IMPROVE Act for funding,” Shane pointed out. “Yet, just a few weeks ago at an event in Mt. Juliet she said that her vote for the tax increase provided the funding for Highway 109 — despite the fact that state Department of Transportation records show it was on the project list in January, 2017 and it was reported in our local papers.” With surplus and recurring funds of over $2 BILLION dollars in our state’s coffers, Lynn raised taxes by $350 million on our families after promising not to do it, Shane said. “Now she is trying to fool people into believing that her tax increase was really a tax cut! The next…

Read the full storyGas Can Man ‘Fuels’ Renewed Anger Over Gas Tax Increase in Murfreesboro

Gas Can Man made a pit stop in Murfreesboro early Friday morning at DJ Mart on Lascassas Pike to pump out $25 in free gas to 100 lucky – and very happy – drivers. SuperTalk 99.7 WTN morning host Brian Wilson announced the location of the Energize America giveaway at 7:05 am and within 10 minutes dozens of cars were lined up around the gas station waiting for the fuel to flow at 7:30 am. Within less than an hour the giveaway ended after the one hundredth car had been “pumped up.” One driver, who got out of his car for a selfie with Gas Can Man, said his low fuel light came on while he was waiting in line. Several drivers pointed out that fuel prices are moving back towards $3 per gallon and that legislators who added to the “pain at the pump” should pay a price. “I don’t know how my representative voted, but I will find out if they voted for the tax increase,” one man exclaimed. “And I’ll tell him they voted last year but I get to vote this year!” The $25 in free gas provided to drivers who were quick to arrive represented the…

Read the full storyGas Can Man Headed to Murfreesboro Friday Morning to Protest Gas Tax Increase and Dish Out Free Gas

One hundred early morning drivers in Murfreesboro will get up to $25 towards a fill up in free gas thanks to Gas Can Man this Friday. The $25 represents about a month’s worth of the fuel taxes the average Tennessee driver is paying thanks to the gas tax increase passed by the legislature last year. Gas Can Man will promote the need to oppose higher federal gas taxes and repeal the gas tax increase that Tennessee imposed last year. Gas Can Man is part of the Energize America Coalition that has done over 50 similar events across the country in the last few years. The first 100 drivers at 7:30 am Friday morning in Murfreesboro will get up to $25 towards a fill up! To find out exactly where the gasoline giveaway will take place, tune into SuperTalk 99.7 WTN at 7:05 am Friday morning or go to Gas Can Man on Facebook to find the location. Tennessee Star readers will also find the location posted promptly at 7:05 am on Friday on the Facebook page for The Tennessee Star. Governor Bill Haslam and the Tennessee legislature permanently raised fuel taxes by over $300 million a year, despite Tennessee having…

Read the full storyRutherford County Mayoral Candidates Ketron and Jones Differ on Gas Tax As Early Voting Begins

State Senator Bill Ketron (R-Murfreesboro), who is running to replace the retiring Rutherford County Mayor Ernest Burgess, exchanged volleys with rival and former County Commissioner Tina Jones over the gas tax and the Nashville transit plan this week, just as early voting in the May 1 primary election began. Ketron has endorsed the idea of a monorail running from Nashville to Murfreesboro. He has not “publicly endorsed” the Barry transit plan for Nashville, but he has expressed support for her light rail plans by text as soon as she announced them. Ketron has not denied “privately” endorsing the Barry transit plan, as WKRN reported. Jones has pointed out that Nashville wouldn’t even be having a tax increase referendum had it not been authorized by the Ketron-supported IMPROVE Act, Governor Haslam’s gas tax increase that passed the Tennessee General Assembly and was signed into law last year, which would also enable a similar tax increase referendum in Rutherford County. In her statement voicing strong opposition to the $9 billion transit plan proposal “Let’s Move Nashville,” Jones asserted: When Senator Bill Ketron voted for the gasoline tax increase as part of the IMPROVE Act, he voted to allow local tax increases like…

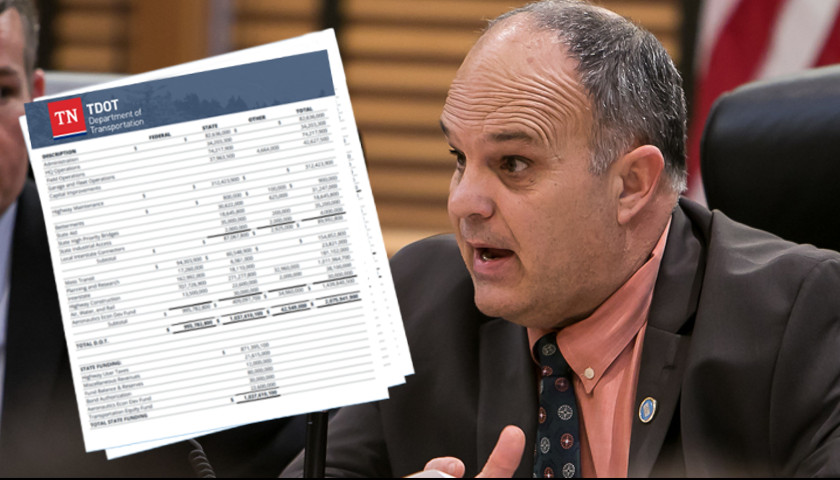

Read the full storyTDOT: Uncertainty Over Federal Funding Puts 962 Projects Promised with IMPROVE Act Gas Tax Increase In Jeopardy

During this session’s first meeting of the House Transportation Committee, chaired by Rep. Barry Doss (R-Leoma), the Tennessee Department of Transportation (TDOT) presented their budget for fiscal year 2019, revealing that the uncertainty surrounding the 47 percent of the department’s budget that comes from federal funding puts the 962 projects listed in the IMPROVE Act in jeopardy. TDOT Commissioner John Schroer was joined by Chief Engineer Paul Degges and Chief Financial Officer Joe Galbato. Degges and Galbato both gave overviews of their respective departmental areas, and were followed by Commissioner Schroer, who spoke on the uncertainty surrounding federal funding to TDOT. This is a result of the spending authorization that expires this week as well as the continued use of short-term spending authorizations. Additionally, the federal FAST Act – Fixing America’s Surface Transportation Act, authorized in 2015 expires in 2020, which Schroer said “Gave us money they didn’t have.” Since they didn’t have all of the money to cover the “pay fors,” it may result in a rescission of that money in 2020, which totals $170 million for Tennessee. TDOT CFO Galbato said that with the passage of the IMPROVE Act, the state is down from about 55 percent federal…

Read the full storyCommentary: With Federal Gas Tax Hike Proposal The West Wing Democrats Try To Kill The Trump Presidency Again

by George Rasley, ConservativeHQ.com Editor Every time we begin to think that President Trump’s economic advisor Gary Cohn and the other Democrats the President brought into in the West Wing have lost influence, one of them surfaces to remind us of what a huge mistake it was for Trump to let them inside the White House fence, let alone give them big offices in the White House. Cohn’s latest contribution to killing the Trump presidency is the idea of raising the gas tax – with this tone-deaf idea being floated in the middle of the President’s push to cut income taxes on America’s middle-income families and job-creating businesses. What Cohn, and those who inhabit his portal to portal limo riding world, don’t seem to get is how gasoline and transportation costs affect the quality of life for middle and lower income families. As a 2016 Pew study showed, the share of household income used for transportation has increased substantially over the past two decades, the amount going to various subcategories, like gasoline, also grew. For all income groups, expenditures for gasoline and motor oil doubled between 1996 and 2014. For households in the lower third, the average annual cost…

Read the full storyGov. Haslam’s Gas Tax Increase Sponsor ‘Boss’ Doss Offers No Explanation Why His Company’s Equipment Is Being Used on Road Construction Project

ARDMORE, Tennessee – Doss Brothers Inc., the construction company owned by State Rep. Barry “Boss” Doss (R-Leoma), the House sponsor of Governor Bill Haslam’s gas-tax increasing IMPROVE Act, is currently performing work at a road construction site on SR 7 in Ardmore, Tennessee, as well as several Giles County locations which lie within the House District 70, which he currently represents. According to TDOT records (page 10 of 17) and Bid Express, the “Secure Internet Bidding” website that handles departments of transportation for 38 states including Tennessee, the bid was “generated” on March 6, 2017, and “let” (awarded) on March 31, 2017. The successful bidding contractor was Rogers Group, Inc., with a “Total Bid” of $2,290,682.00 and a “completion time on or before December 15, 2017,” for “The grading, drainage and paving on U.S. 31 (S.R. 7) from Union Hill Road to Morrow Road in Ardmore,” Giles County Doss Brothers, Inc. heavy equipment, clearly marked as such, has been unmistakably observed within the past week at a road construction site on SR 7 in Ardmore, Tennessee, as seen in the image on the right. The Tennessee Star asked Rep. Doss to comment as to whether Doss Brothers, Inc. equipment has been used on a road construction project…

Read the full storyGas Tax Opponent Menda Holmes Announces Candidacy for 46th District in Tennessee House to Replace Mark Pody, Now a State Senate Contender

Menda Holmes, chairman of the Wilson County Tea Party and an avid opponent of Governor Haslam’s gas tax increase, announced her candidacy for the Republican nomination to represent the 46th District in the the Tennessee House of Representatives on Friday. Holmes was one of 50 leading Tennessee conservatives who signed a letter to the Tennessee General Assembly opposing the gas tax increase back in March, as The Tennessee Star reported at the time. The district is currently represented by State Rep. Mark Pody (R-Lebanon), who has announced he will not run for re-election, but will instead run for the State Senate seat currently held by State Senator Mae Beavers (R-Mt. Juliet). Beavers is not running for re-election, but instead is one of five candidates seeking the Republican nomination for governor. “As a self-employed business owner and the daughter Albert McCall Sr., owner of D.T. McCall and Sons, Holmes has been a resident of Wilson County for the past 28 years. She holds a bachelor’s degree from Trevecca University and is the mother of two grown children. Holmes lives in the southwestern part of the county with her husband, Howard, and they are both active members at New Vision Baptist…

Read the full storyCongressional Candidate John Rose: ‘I Fully Support’ Governor Haslam’s Gas Tax Increase

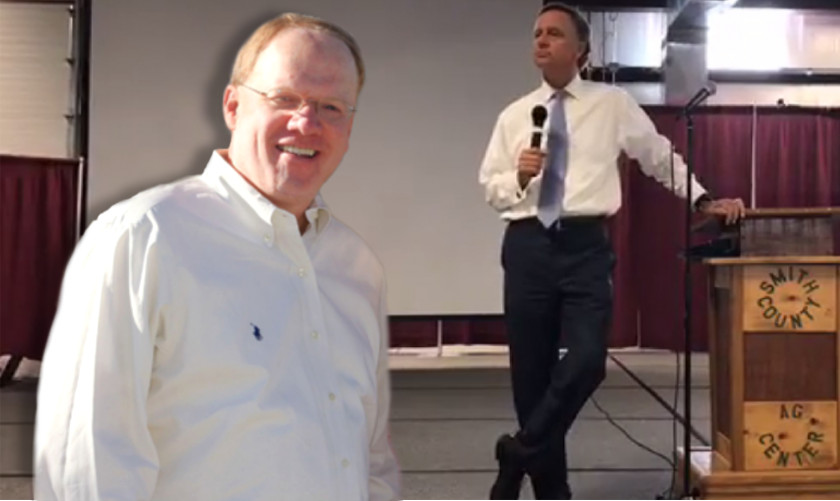

At a February event in Smith County that featured Governor Haslam promoting his proposed gas tax increase, recently announced Sixth Congressional District candidate John Rose told the governor, “I just want to say I applaud you for making this proposal. I fully support it.” You can hear Rose make these comments to the governor beginning at the 54:16 mark (42:05 from the end) of this video tape of the event, provided courtesy of the Smith County Insider: Here is a partial transcript of Rose’s comments from that day: Governor, I’m John Rose and I’m a businessman and farmer here in the community and have lived here for the last 42 years on the edge of Smith County line , De Kalb County, my farm is actually in De Kalb County. . . As I mentioned, I’m a businessman, and my business is in Nashville so I commute back and forth from Smith County to Nashville . . I want to just say that I applaud you for this proposal. I fully support it. I think that having users of our roads pay for our roads makes tremendous sense. You’ve laid out a very strong case for for why…

Read the full storyState Rep. Bill Sanderson Led Defeat of Refugee Resettlement Bill in 2013, Backed Gas Tax Increase in 2017, Wants Voters to Support Him Again in 2018

State Rep. Bill Sanderson, chairman of the House State Government Subcommittee passionately opposed a 2013 bill intended to quantify how much state revenue was forcibly being diverted by the federal government to pay for its refugee resettlement program. First elected to the General Assembly in 2011, Sanderson voted for the gas tax this year. Last week, gubernatorial candidate Speaker Beth Harwell (R-Nashville) announced that she is supporting Sanderson’s bid to continue representing voters in his district at an event held in Kenton, Tennessee. After Governor Bredesen, a Democrat, had withdrawn Tennessee from the federal program in 2008, the U.S. Office of Refugee Resettlement chose Catholic Charities of Tennessee (CCTN) to continue the resettlement program for the state. The federal government also continued to rely on state revenue to support refugees resettled by the federal contractors in Tennessee. Testimony provided during debate on the 2013 bill cited a seventy-five percent increase in refugee arriving to Tennessee since CCTN took over the program even though the number of refugees arriving to the U.S. were declining. The bill still received enough votes to go to the full committee even with Sanderson abstaining from voting. In the full committee Sanderson spoke extensively against the bill after…

Read the full storyGas Tax Approving State Representative Bill Sanderson Gets Support From Gubernatorial Candidate and House Speaker Beth Harwell

Gubernatorial candidate and Speaker of the Tennessee House of Representatives Beth Harwell (R-Nashville) was a featured speaker at an event in support of Rep. Bill Sanderson (R-Kenton) who voted for the gas tax increasing IMPROVE Act and said he will be facing a challenger in the 2018 Republican primary. Also speaking at the event, which Sanderson said was arranged by Farmers Insurance agent Tom Eison and lobbyist for Farmers Group Inc. PAC Harvey Fischer, was State Senator Ed Jackson (R-Jackson), who praised Sanderson’s work in the legislature. Jackson and Harwell both also voted in favor of the IMPROVE Act. The State Gazette reported that approximately 75 people were in attendance at the event, to which all three speakers seemed to defend the vote in favor of the gas tax increase, focusing instead on the other aspects of the IMPROVE Act which Sanderson referred to as “the largest tax cut in the state of Tennessee’s history.” Harwell, said one of the most important things she does as Speaker is “determine who will chair my committees,” in introducing Sanderson, who chairs her State Government Committee. One of the three challenges Harwell says she gave to Sanderson and “all of his colleagues,”…

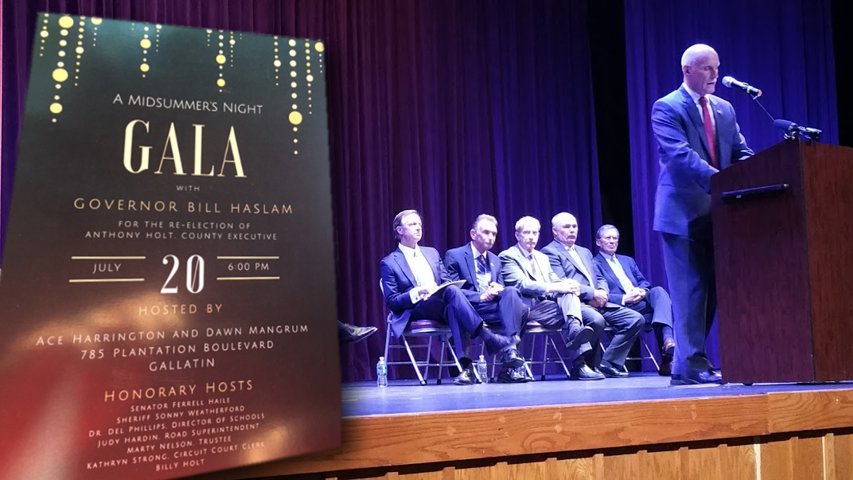

Read the full storyGovernor Haslam Featured Supporter at Event for Gas Tax Promoter, Sumner County Executive Anthony Holt

Governor Bill Haslam was the featured guest at the July 20 “A Midsummer’s Night Gala” fund raising event “for the Re-election of Anthony Holt, County Executive,” a fervent supporter of the governor’s gas-tax increasing IMPROVE Act and host of a Sumner County town hall on the topic February 22. Holt was an early promoter of what would eventually become the controversial IMPROVE Act, when he brought to the county Legislative Committee “A Resolution of Support for Enhanced, Sustainable Funding for Transportation Needs for the State of Tennessee and for Local Communities” back in April 2016. Holt reported to the Legislative Committee that the resolution had been developed by the MPO – Nashville Area Metropolitan Planning Organization – of which Holt is a member. According to its website, the MPO was established through federal legislation and “facilitates strategic planning for the region’s multi-modal transportation system.” At the time, the state had more than a half-billion dollar budget surplus, yet the transportation resolution urged the Tennessee General Assembly to provide funding other than the over-collected taxes that would account for inflation and allow cities and counties the option to tax for transportation needs, including transit options. The IMPROVE Act increased the…

Read the full storyFinal Piece of New Jersey’s Gas Tax Hike Went Into Effect on Saturday

Drivers of diesel-fueled vehicles in New Jersey saw their prices rise at the pump on Saturday as the second half of the state’s motor fuel tax increase takes effect, which also could raise shipping costs for online shoppers. The state tax on gasoline was increased by 23 cents per gallon in November, but an eight cent hike on…

Read the full story