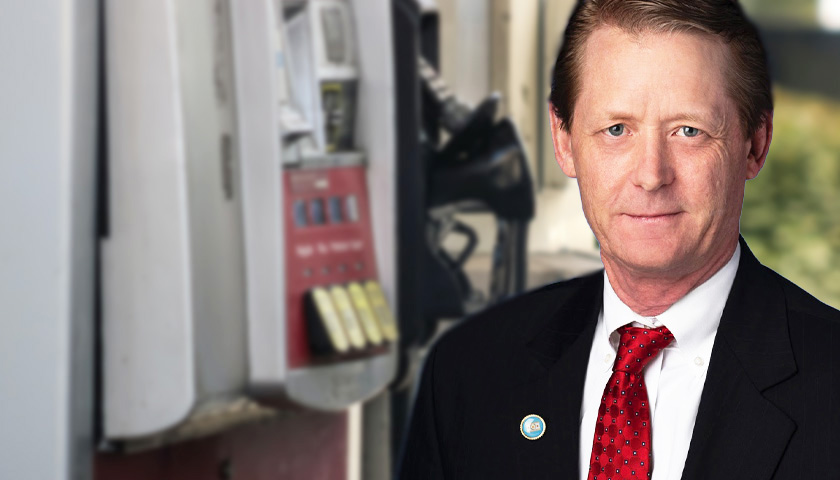

There are few more easily observable measures of the cost of everyday living than the price of gasoline at the pump. As has been widely reported, gas prices in the United States recently hit a seven-year high. The striking thing, however, is not just how high gas prices have gotten, but how fast and far they have risen.

Based on statistics from the U.S. Energy Information Administration—the statistical arm of the Department of Energy—weekly average retail prices for regular unleaded gasoline in the United States increased 94 percent in less than two years. Average gas prices rose from $1.77 per gallon during the week ending April 27, 2020, to $3.44 per gallon during the week ending February 7, 2022—nearly doubling in the process.

That was the largest percentage increase in gas prices within a two-year window since October of 2005, more than 16 years ago. In the election of 2006, Republicans—then the party in power—lost 30 House and six Senate seats, thereby losing control of both chambers, before losing the presidency two years later.

Read the full story